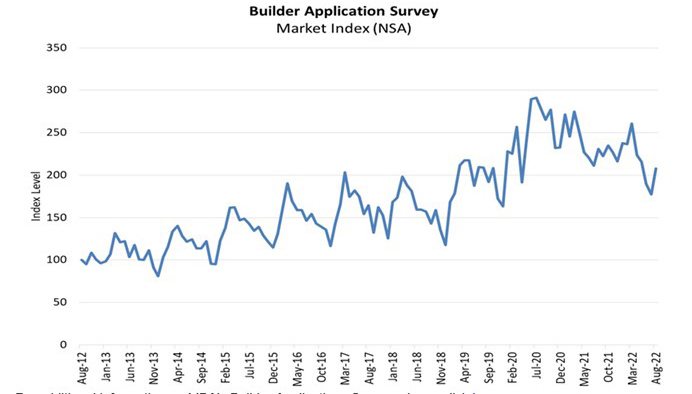

MBA Builder Applications Survey Up 17% from July

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in August rose by 17 percent from July—the first monthly increase in four months—but fell by 10.1 percent from a year ago.

By product type, conventional loans comprised 72.1 percent of loan applications, FHA loans 17.0 percent, RHS/USDA loans 0.2 percent and VA loans 10.7 percent. The average loan size of new homes decreased from $416,029 in July to $415,594 in August.

MBA estimated new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, came in at a seasonally adjusted annual rate of 699,000 units in August, an increase of 18.3 percent from the July pace of 591,000 units to its best pace since May. On an unadjusted basis, MBA estimates 58,000 new home sales in August, an increase of 16 percent from 50,000 new home sales in July.

“New home purchase applications were down year-over-year but rebounded in August after four consecutive months of declines, despite higher mortgage rates, declining homebuilder sentiment and looming economic uncertainty,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “The average loan size decreased for the fourth straight month, which is a sign of slowing home-price growth in the new homes market. Ongoing volatility in mortgage rates in the months ahead may lead to larger swings than is typical in the pace of new home sales. Between moderating sales prices and volatile mortgage rates, buyers seem to be biding their time.”

Kan noted despite the month over month increase in single-family sales, “the current sales pace is still 23 percent lower than the November 2021 peak and is down 20 percent from last year.”

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The MBA Builder Applications Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using these data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state and metro level. These data also provide information regarding types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In those data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information on the MBA Builder Applications Survey, click here.