BREAKING NEWS

MBA: Mortgage Credit Availability Index Falls for 6th Straight Month

NASHVILLE, TENN.—Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, said sound risk management practices make the difference in an evolving mortgage market.

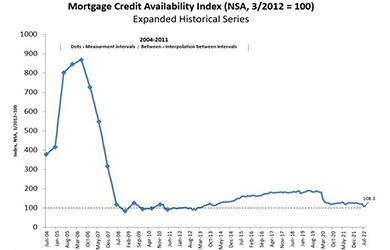

Mortgage credit availability fell for the sixth straight month in August, remaining at its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.

CoreLogic, Irvine, Calif., reported a 7.5 percent year over year decrease in fraud risk in as of the end of the second quarter.

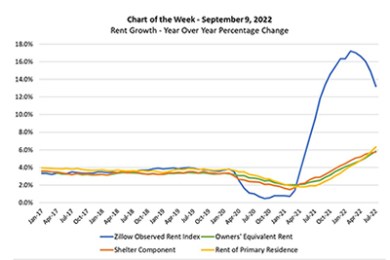

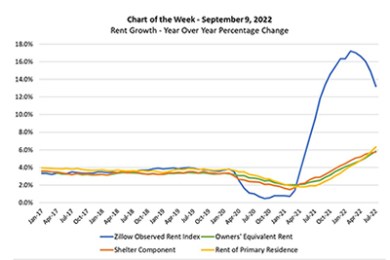

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?

Address consumers' credit score from the very beginning to maximize their full credit potential. Qualify more applicants. Increase purchasing power. Secure lower rates.

Grandbridge Real Estate Capital, Charlotte, secured $47.9 million for seniors housing and multifamily properties in North Carolina, Minnesota and North Dakota.

One way for lenders to manage productivity while responding proactively is to join hands with reliable mortgage processing partners who can offer strong support and let lenders focus on market expansion.

Curtis Richins is President & CEO of Mortgage Capital Trading and Agile Trading Technologies, San Diego. He is experienced in international finance, marketing, risk management and business operations. He has worked extensively in Europe, in addition to his U.S.-based mortgage banking experience.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Each quarter, PerformLine hosts a regulatory compliance roundtable for the mortgage industry that gathers mortgage professionals to have open and productive conversations about the challenges they’re facing in the regulatory environment and best practices for ensuring compliance and consumer protection.

NAMMBA and iEmergent have been working to create a tool (called Diversifi) that will allow anyone in the real estate finance business to better understand the market they serve, reach more of that market and create connections and relationships with them.

The Mortgage Bankers Association's annual Regulatory Compliance Conference takes place Sept. 18-20 at the Grand Hyatt in Washington, D.C.