CoreLogic: 2Q Mortgage Fraud Risk Drops by 7.5% Year Over Year

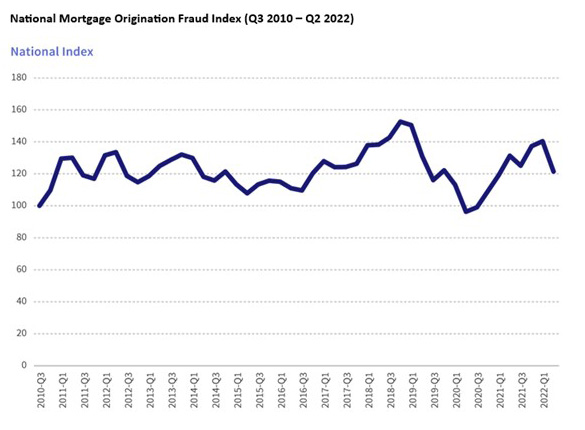

CoreLogic, Irvine, Calif., reported a 7.5 percent year over year decrease in fraud risk in as of the end of the second quarter.

The company’s quarterly Mortgage Fraud Report noted the decline in mid-2022 follows a large increase seen in the same period in 2021 and is partially due to the recalibration of CoreLogic’s scoring model in the first quarter. Since that update, said Bridget Berg, Principal of Industry & Fraud Solutions, said higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

The report estimated 0.76% of all mortgage applications contained fraud, or 1 in 131 applications. By comparison, a year ago, that estimate was 0.83%, or 1 in 120 applications. Risks of income and property fraud posted the largest year-over-year increases in the second quarter, a respective 27.3% and 22.6%. Berg said this trend is perhaps not surprising, considering that purchase loans now account for more mortgage transactions than refinances, and that the former are more susceptible to fraudulent activity.

“Income fraud risk remains a top concern for lenders, but there is a rising focus on property value risk as home prices slow their growth and homes are taking longer to sell,” Berg said. “[Our] data backs up those concerns, as our most predictive flags for both income and property frauds increased in the last year more than 20%.”

Other report findings:

–Nationally, five of the six types of mortgage fraud types CoreLogic tracks showed increased risks since the second quarter. The exception was undisclosed real estate debt, which declined by 12%.

–States with the highest fraud risk increases were Rhode Island, South Dakota, Kentucky, New York and Nebraska. The report noted less-populous states are prone to volatile index values, as small groups of higher-risk loans are more likely to move the index. For instance, Rhode Island’s 60% year-over-year fraud risk increase was in part due to a large share of government-backed loans, which have become riskier over the past year.

–New York moved into the top position for mortgage application fraud risk, with Florida, Rhode Island, Nevada and Connecticut rounding out the top five.