BREAKING NEWS

MBA Purchase Applications Payment Index; Fed Raises Rates by 75 Basis Points

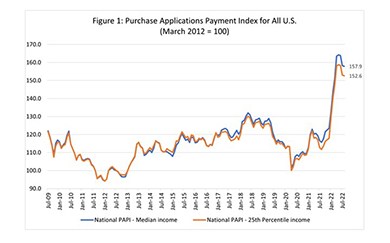

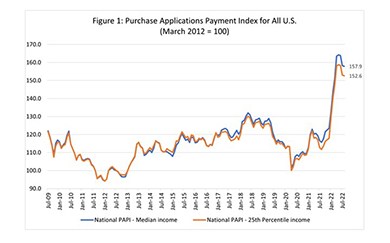

Homebuyer affordability improved in August for the third straight month, with the national median payment applied for by applicants decreasing to $1,839 from $1,844 in July, according to the Mortgage Bankers Association's Purchase Applications Payment Index.

The Federal Open Market Committee raised the federal funds rate by another 75 basis points Wednesday to 3-3.25 percent, the third consecutive such increase and the fifth increase since March.

Existing home sales fell in August for the seventh straight month, the National Association of Realtors reported Wednesday, despite more borrowers locking in rates before they went up.

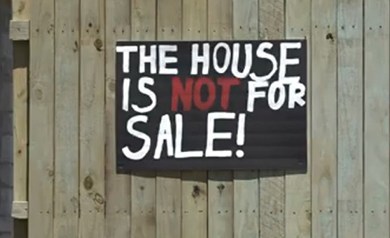

With mortgage interest rates pushing well above 6 percent—the Mortgage Bankers Association on Wednesday reported 30-year rates up by 24 basis points to 6.25%--a growing number of homeowners are reluctant to sell because they have a lower rate locked in, said Redfin, Seattle.

Here’s a quick summary of housing/economic reports that recently came across the MBA NewsLink desk:

Proper quality control reporting can be a compass for lenders in creating efficient and profitable mortgage businesses.

Newmark, New York, sold Gilbert, Ariz., office property The Reserve at San Tan for $53.1 million.

WASHINGTON D.C. – The Mortgage Bankers Association presented its annual Ken Markison Legacy Achievement Award to Travis Dyson, CMB, of Flagstar Bank, Troy, Mich.

Mortgage applications rose for the first time in six weeks despite another sharp jump in mortgage interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 16.

KBRA, New York, recently published a report, SFR Securitizations: A Decade in the Making, analyzing the sector’s evolution and growth. MBA Newslink interviewed the report’s authors about the factors driving the sector’s growth.

While lenders are doing their best to leverage new technology in the battle against cost and inefficiency, for many, the efforts are almost entirely an in-house effort. Considering that production of a mortgage lies in the hands of multiple entities—the lender, perhaps a mortgage broker, the title and closing company, the appraiser and the like—that may well be a mistake.

Kimberly Phegley joined FirstBank in 2017 and currently serves as the company’s Chief Audit Executive. She is responsible for leading and managing an effective, risk-based audit strategy for all the bank’s businesses and corporate functions.

As someone who has been advising lenders on market strategy for years, I can say that developing SPCPs is neither risky nor mysterious when driven by sound data. Like any well-designed lending program, SPCPs require engaging in intentional, market data-based product design and performance evaluation — a practice that every lender could benefit from if it is not already.