BREAKING NEWS

Homebuyer Affordability Drops in September as Interest Rates Surge

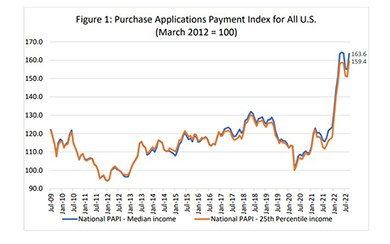

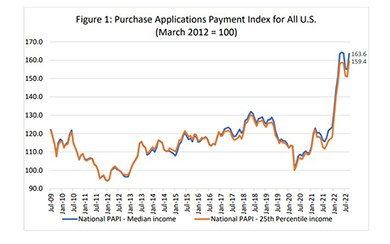

Homebuyer affordability dropped in September, as the national median payment applied for by applicants increased by 5.5 percent to $1,941 from $1,839 in August, according to the Mortgage Bankers Association's Purchase Applications Payment Index.

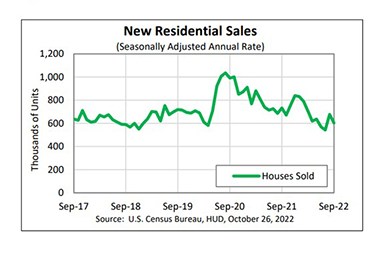

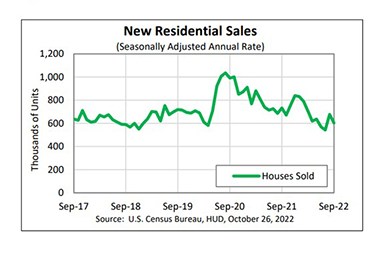

New home sales fell by nearly 11 percent in September, HUD and the Census Bureau reported Wednesday, as rising interest rates discouraged home buyers.

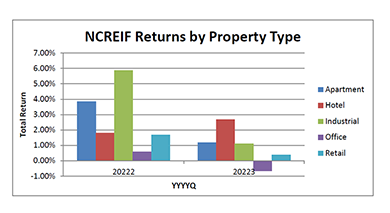

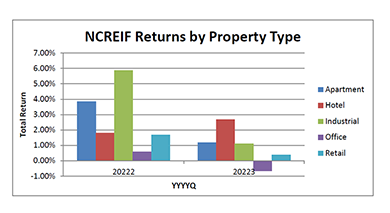

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned 0.57% in the third quarter, down from 3.24% in the second quarter.

NASHVILLE—In the current volatile economic environment, former Federal Reserve Vice Chair Roger Ferguson said the best qualities in formulating economic policy are evenhandedness and empathy.

NASHVILLE – The MBA Opens Doors Foundation announced recipients of its annual awards, which recognize those who have made lasting contributions to advance the Foundation's mission of providing mortgage and rental assistance to families with critically ill or injured children.

NASHVILLE—All professionals face challenges in the workplace, but executive coach Nichole Provonchee says decades of research by academics and her own research shows women face specific challenges more often than their male counterparts.

Megan Booth joined the Mortgage Bankers Association’s Commercial/Multifamily Department as Associate Vice President of Commercial/Multifamily Policy.

Institutional Property Advisors, Ontario, Calif., sold TBC Headquarters, a single-tenant office building in Palm Beach Gardens, Fla., for $15.5 million or $348 per square foot.

At the recent Mortgage Bankers Risk Management, Quality Assurance and Fraud Prevention conference, Fannie Mae hinted at forthcoming changes to its pre-funding quality control requirements. While specifics regarding the changes remain to be seen, the teaser serves as a warning for lenders to shore up their current pre-funding QC program to ensure they are ready to meet the new standards.

As the federal government and other high profile financial services providers have embraced the cloud, lenders increasingly consider open banking a safe and efficient option to hosting services in their own data centers. This is a positive development for reasons that benefit borrowers and lenders alike.

Climate change may seem like a distant topic to many, but it has the potential to affect various industries in many different ways. The mortgage industry, in particular, faces unique risks due to climate change and its impacts.

In his first year as Director of the CFPB, Chopra has taken an aggressive approach to consumer protection through market monitoring inquiries, interpretive rules, circulars, advisory notices, and enforcement actions.