BREAKING NEWS

MBA Weekly Applications Survey; FHFA Announces 2023 GSE Conforming Loan Limits

Mortgage applications fell for the first time in three weeks despite interest rates falling below 6.5 percent, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending November 25.

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

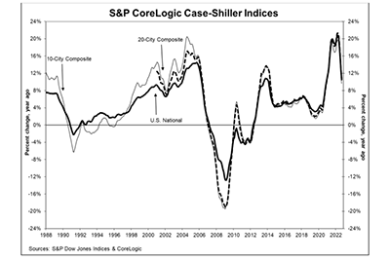

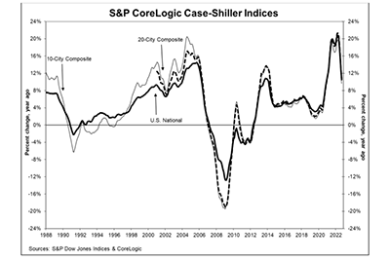

Reports from S&P Down Jones Indices, New York, and the Federal Housing Finance Agency show continued flattening of home prices nationwide, although they remain elevated in most markets.

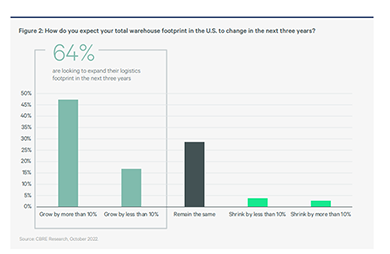

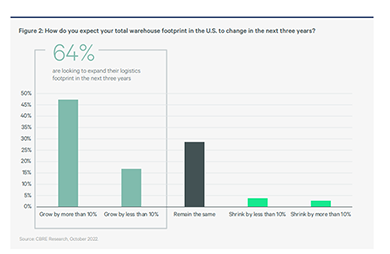

Strong industrial market demand will likely continue, though not at the record pace set in 2021, said CBRE, Dallas.

M&T Realty Capital Corp., Baltimore, recently closed multiple deals in New York totaling $33.6 million.

There is a great deal of uncertainty as to the health of the U.S. real estate business in 2023, of course, and we’re all hearing plenty of negative narrative as the industry contracts in the face of lower overall loan volumes. However, that’s not what many lenders are focused on. We’ve spoken to many lenders who are finding bright spots – opportunities amidst the challenges.

here are still opportunities to be found amid this difficult market. One of the best opportunities, in fact, are home equity loans, particularly HELOCs, and closed-end seconds as well—products for which borrower demand is still relatively strong. And this opportunity becomes even brighter with the right resources in place.

As mortgage marketers eagerly look to put ‘22 in the rearview mirror, now’s the time to start plotting a competitive social media strategy for ‘23. So, if you’re wondering, “what’s next?”, you’re not alone.

While no one has a magic ball that can tell us when the market will pick up again, it’s a good idea for executives at financial institutions to rethink and consider what a realistic strategy looks like moving forward in a low market as well as a high market.

More originators will look to partner with servicers that have the expertise to manage the regulatory and compliance requirements, which is undeniably the most critical factor to consider when choosing a servicer.

The Conference of State Bank Supervisors encourages state licensees to begin taking steps to prepare for the Nationwide State Licensing System license renewal period. Federally registered MLOs and institutions must also renew their registrations via NMLS by Dec. 31.