BREAKING NEWS

Mortgage Applications Fall in MBA Weekly Survey

Mortgage rates rose again last week to their highest level since 2019, resulting in a drop in refinance applications—although purchase applications rose slightly—the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 11.

Here’s a quick recap of housing market stories that have recently come across the MBA NewsLink desk:

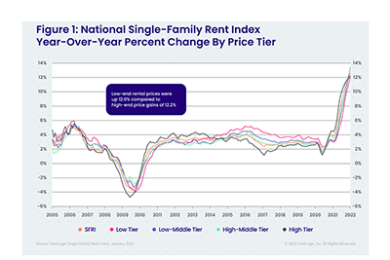

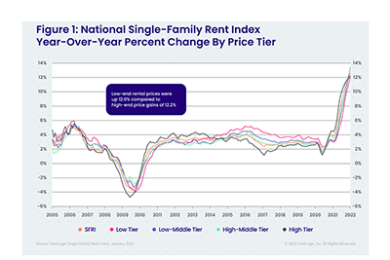

CoreLogic, Irvine, Calif., said single-family rent growth started 2022 strong by increasing 12.6 percent year-over-year in January.

Deephaven Mortgage, Charlotte, N.C., appointed Lisa Heitzmann, CMB, as Chief Operating Officer. She will oversee operations of Deephaven’s internal underwriting, wholesale and correspondent teams.

The Mortgage Bankers Association’s annual Technology Solutions Conference & Expo takes place Apr. 11-14 at the Bellagio Las Vegas.

The Mortgage Credit Potential Index™ (MCPI) is a monthly reporting of mortgage credit inquiries analyzed by CreditXpert’s predictive analytics platform.

Wolters Kluwer Governance, Risk & Compliance, Minneapolis, signed an agreement with The Reynolds and Reynolds Co. to acquire International Document Services Inc., Draper, Utah, a provider of compliance and document generation software platforms for the mortgage and real estate industry, for $70 million in cash.

CBRE, Dallas, arranged a $72.2 million loan for the Postcard Inn on St. Pete Beach, Fla., on a barrier island west of St. Petersburg.

Being a better educator starts with having a full picture of the borrower’s financial situation. By taking a consultative approach, loan officers can ask questions to better understand what goals the potential borrower is trying to achieve. LOs can then provide the appropriate financial education that is relevant to best prepare them for homeownership.

As technologies and their principles pushed forth by digital transformation initiatives employing such as cloud, Web 3.0, decentralized finance (DeFi), and blockchain mortgage, the enterprise transactional mindsets and systems of record must evolve into stackable solutions—or risk stranding investments and customers on vendor platforms that cannot adapt to future requirements.

Whether you plan to buy or sell a company in 2021, these factors can greatly increase your chances of success.

Retention is the new acquisition and likely the most important KPI in the digital age. While the focus has historically been on acquiring new leads for revenue generation, the mortgage industry is now shifting its emphasis to retaining customers by enhancing the overall borrower experience.

When you achieve great success as a lender, everyone wants to know your secret—but there really isn’t one. There are many ways to run an enterprise, but at the end of the day, every business must be about the customer. The ultimate goal, however, is building customers for life.