Office Sector Sees Uncertainty

Office usage is slowly growing as the pandemic fades, but analysts have many questions about the sector’s future.

The good news is U.S. employment continues to grow; the Bureau of Labor Statistics announced Friday employment rose by 678,000 in February. And several major employers including Google, Wells Fargo and American Express have announced plans for employees to return to their offices in March or early April.

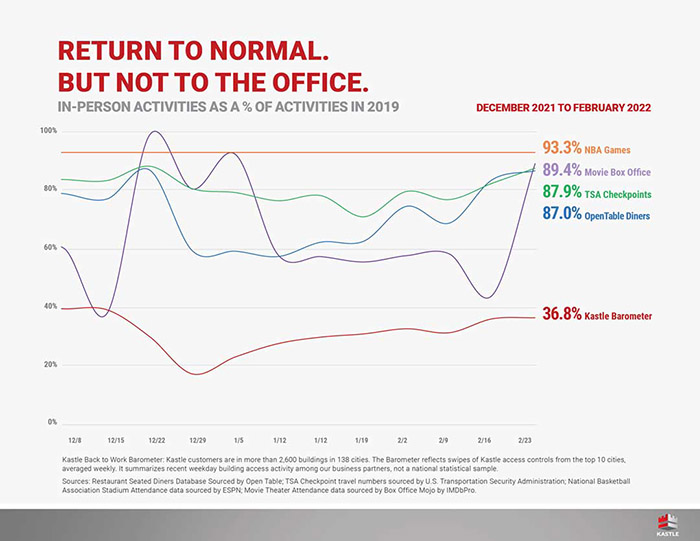

Office monitoring firm Kastle Systems, Falls Church, Va., tracks the number of users entering offices in the 10 largest U.S. cities compared to a pre-COVID baseline. The firm’s Back to Work Barometer report rose to 36.8 percent on Feb. 28 from 31.6 percent two weeks before.

But the rise of remote work raises questions about the future of the property type, Marcus & Millichap, Calabasas, Calif., said in its U.S Office Investment Report.

“Offices continue to serve as homes for critical operations and are now reintroducing their roles as focal points for creative discovery, collaboration and training,” Marcus & Millichap said. “The utilization of office space by staff rose steadily throughout last year. While interrupted at the outset of 2022 by the spread of the omicron variant, employees will resume returning to offices in the year ahead, provided new variants do not emerge.”

This return to the workplace will likely look different depending on companies, individual offices and metro areas, Marcus & Millichap noted. “While technology firms have the infrastructure to support a distributed workforce, they have also continued to grow their real estate footprint,” the report said. “Businesses in other fields had already brought staff back in but continue to adjust operations as needed. Employees are generally open to returning at least a few days per week.”

New remote work habits and a tight labor market increase pressure on office property owners to offer compelling amenities, Marcus & Millichap said. “Layouts and technology that facilitate collaboration with hybrid teams while maintaining some private spaces are top of mind,” the report said.

Marcus & Millichap said office transaction velocity improved markedly last year following a significant contraction in 2020 as investors who had paused their decision-making during initial COVID-related uncertainty reentered the market. They favored properties with credit tenants and long lease terms, the report said. It noted buyers now carefully evaluating the build-out of the asset and its location down the neighborhood level before investing.