Home Flipping Spikes; Profits Don’t

ATTOM, Irvine, Calif., reported a sharp increase in home flipping in the first quarter—but profits did not necessarily follow suit.

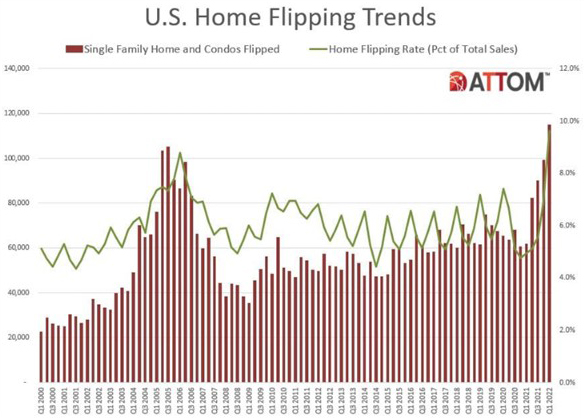

The company’s first-quarter U.S. Home Flipping Report saw 114,706 single-family houses and condominiums in the United States flipped, representing 9.6 percent of all home sales in the first quarter—the highest level since at least 2000. This was up from 6.9 percent during the fourth quarter and from 4.9 percent a year ago.

The jump in the home-flipping rate during the first quarter of this year marked the fifth straight quarterly increase. It also represented the largest quarterly and annual percentage-point gains since 2000.

However, the report also said typical raw profits on those deals remained below where they were a year ago, and in a more striking trend, profit margins dipped to their lowest point since 2009.

“The good news for fix-and-flip investors is that demand remains strong from prospective homebuyers, as evidenced by this quarter’s report, which shows that one of every 10 homes sold during Q1 was a flip,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “The bad news is that rising mortgage interest rates are beginning to slow down home price appreciation rates, and buyers have become more selective – and less willing to outbid other buyers for properties they’re interested in. This is having a predictable impact on profit margins for investors.”

Among all flips nationwide, gross profit on typical transactions (the difference between the median purchase price paid by investors and the median resale price) stood at $67,000 in the first quarter, up 5.5 percent from $63,500 in the fourth quarter, the first increase since late 2020, it was 4.3 percent less than the $70,000 level recorded a year ago.

Profit margins, meanwhile, fell for the sixth quarter in a row, as the typical gross-flipping profit of $67,000 in the first quarter translated into just a 25.8 percent return on investment compared to the original acquisition price. The national gross-flipping ROI fell from from 27.3 percent in the fourth quarter and from 38.9 percent a year earlier. It sat at the lowest point since first quarter 2009, when the housing market was slumping from the effects of the Great Recession in the late 2000s.

The latest return on investment also was less than half the peak of 53.1 percent for this century, which hit in late 2016.

The report said profit margins declined in the first quarter as resale prices on flipped homes continued to shoot up more slowly than they were when investors originally bought their properties. Specifically, the median price of homes flipped in the first quarter increased to a record-high $327,000, up 10.5 percent from $296,000 in the fourth quarter and 30.8 percent from $250,000 a year earlier. Both increases stood out as the largest for flipped properties since 2000.

Home flips as a portion of all sales increasd in 181 of the 191 metropolitan statistical areas around the U.S. analyzed for this report (95 percent).

“As interest rates continue to go up, cash buyers should be in an even greater position of competitive advantage in the fix-and-flip market,” Sharga noted. “It will be interesting to see if the percentage of cash purchases, and purchases made by larger, better capitalized investors, increases over the next few quarters.”