Inflation Still Too High for Consumers—and Fed

Inflation showed no signs of letup in May, the Bureau of Labor Statistics reported Friday, with analysts all but guaranteeing large interest rate hikes by the Federal Reserve this week and in the coming months.

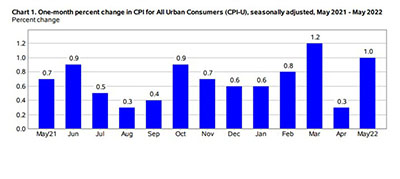

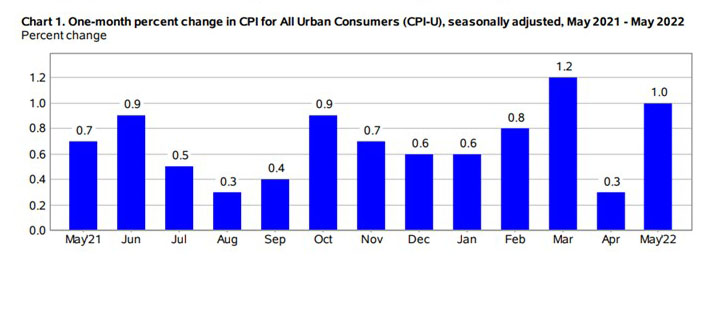

The Consumer Price Index increased by 1.0 percent in May on a seasonally adjusted basis after rising 0.3 percent in April, BLS said. Over the past 12 months, the all-items index increased by 8.6 percent before seasonal adjustment, the largest increase since December 1981.

BLS reported broad-based increases, with the indexes for shelter, gasoline and food the largest contributors. After declining in April, the energy index rose by 3.9 percent over the month, with the gasoline index rising 4.1 percent and the other major component indexes also increasing. The food index rose 1.2 percent in May as the food at home index increased 1.4 percent.

The index for all items less food and energy rose by 0.6 percent in May, the same increase as in April. While nearly all major components increased over the month, largest contributors were indexes for shelter, airline fares, used cars and trucks and new vehicles. Indexes for medical care, household furnishings and operations, recreation and apparel also increased.

The all-items less food and energy index rose by 6.0 percent over the past 12 months. The energy index rose by 34.6 percent over the past year, the largest 12-month increase since the period ending September 2005. The food index increased by 10.1 percent for the 12-months ending May, the first increase of 10 percent or more since the period ending March 1981.

“Inflationary pressures were seen nearly everywhere,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Simply put, inflation remains far too high for the Federal Reserve’s liking. Until inflation is demonstrably on the downswing, we expect the FOMC to fight back aggressively with tighter policy. Another 50 basis point rate hike is all but assured at [this] week’s FOMC meeting, and a couple more 50 basis point hikes in July and September seem highly likely.”