BREAKING NEWS

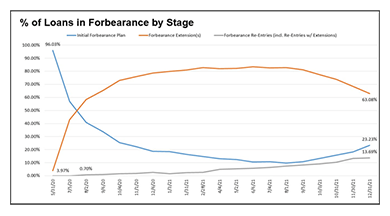

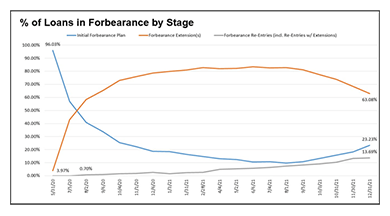

Loans in Forbearance Fall to 1.41%; Applications, Rates Rise Again in MBA Weekly Survey

Loans now in forbearance decreased 26 basis points during December to 1.41% of servicers’ portfolio volume as of December 31, the Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported.

For the second straight week, rising mortgage interest rates sent home buyers scurrying for mortgage applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 14.

Rising inflation concerns and ongoing supply chain disruptions snapped a four-month rise in builder sentiment, even as consumer demand remained robust, the National Association of Home Builders reported Tuesday.

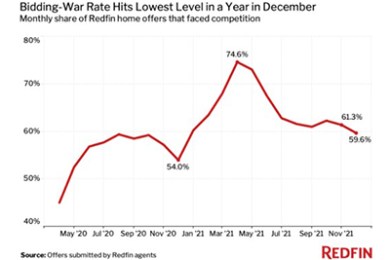

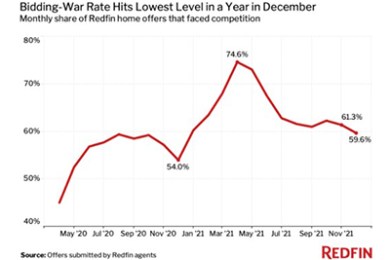

It’s been a most unusual year for housing; the traditional spring home buying season stretched into summer, then fall, then winter. And even amid a slowdown over the holidays, Redfin, Seattle, said bidding wars on homes for sale continued nearly unabated.

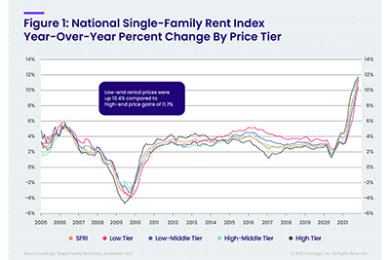

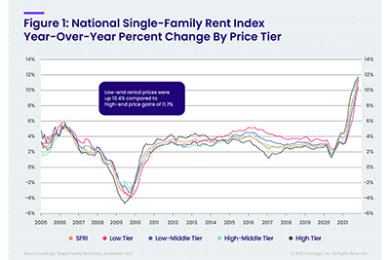

CoreLogic, Irvine, Calif., said single-family rent growth reached 11.5 percent year-over-year in November, continuing its dramatic climb.

The Mortgage Bankers Association announced its newest addition to the MBA Education Certifications and Designations team, Teresa Ferman, who serves as Assistant Director of Career Development Programing.

Merchants Capital, Carmel, Ind., secured more than $141 million in financing for Waterfront Station II, a mixed-income mixed-use property currently under construction in Washington, D.C.

The Mortgage Bankers Association’s Developing Leaders Mentoring Program is a newly launched 12-month program designed to support development of employees within our member organizations.

New American Funding, Tustin, Calif., promoted Christine Obermayer to Vice President of Retention, leading the company’s new Retention Department and focus on helping the company's current customers navigate their refinance options.

First American Financial Corp., Santa Ana, Calif., signed an agreement for its acquisition of Mother Lode Holding Co., a California-based provider of title insurance, underwriting and escrow services for residential and commercial real estate transactions with 17 operating subsidiaries throughout the U.S., including its principal subsidiary Placer Title Co.

You may have picked up on the change in the makeup of tomorrow’s borrower. The growth in home lending market demand is projected to come from traditionally underserved communities and households led by women over the next 20 years. That is not something that most of the lending world is prepared for.

CLEARWATER, FLA.--During a reception at its Winter Summit this week, MISMO®, the real estate finance industry's standards organization, presented awards to key volunteers for their noteworthy standards-related industry contributions.

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.