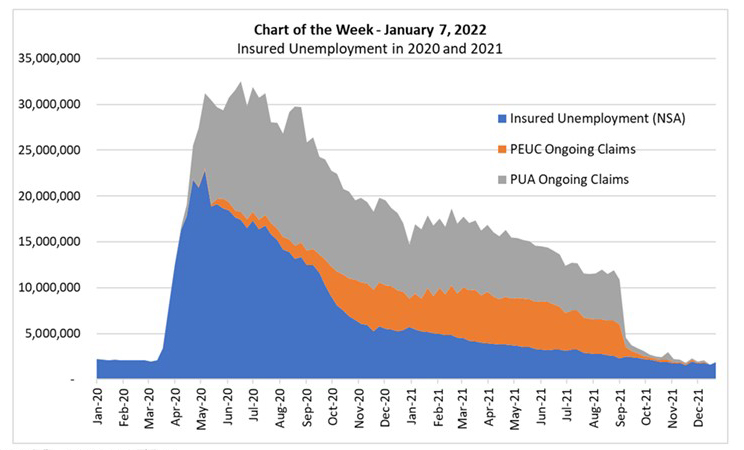

MBA Chart of the Week Jan. 7 2022: Insured Employment 2020-2021

Source: Office of Unemployment Insurance, U.S. Department of Labor.

The Covid-19 pandemic has had an unparalleled effect on labor markets. With insured unemployment continuing claims climbing to (an unadjusted) 1.87 million in yesterday’s Unemployment Insurance Weekly Claims Report, it appears that the omicron variant, as of the end of 2021, has, relative to earlier in the pandemic, only modestly impacted the labor market.

Note that Friday’s monthly employment report from the U.S. Bureau of Labor Statistics is based on data collected the week of December 12 (when new Covid cases were around 150,000 a day), and as such, the Department of Labor’s weekly data provides a timelier picture as omicron spreads.

This week’s MBA Chart of the Week highlights the steep rise in insured unemployment at the start of the pandemic (March 2020) and its steady decline through fall 2021 as the labor market improved (and related government financial support to households waned). The chart shows cumulative weekly ongoing claims for unemployment insurance, the Pandemic Emergency Unemployment Compensation program and the Pandemic Unemployment Assistance program.

In the (pre-pandemic) first 10 weeks of 2020, unemployment insurance continuing claims ran between 2 million and 2.25 million. With the PUA and PEUC programs expiring on September 6, 2021, ongoing claims for these programs dropped dramatically in September and into October, and the unadjusted total of the three programs returned to pre-pandemic levels in November and the first half of December. In the last two weeks of December, the Department of Labor stopped reporting PEUC and PUA numbers in its weekly report, and this week’s 1.87 million reported continuing claims represents an increase of 230,000 from 1.64 million in the prior week.

Together with historically low initial and continuing unemployment insurance claims, this week’s Job Openings and Labor Turnover Survey (JOLTS) report points to a strong labor market with job openings at the end of November at 10.6 million, and a record 3.0% quits rate; today’s employment report corroborates this. Job growth averaged 537,000 jobs per month in 2021, an extremely strong year by any measure, and a rapid rebound from the low point of 2020. The unemployment rate is currently at 3.9% and is forecast to fall to 3.5% in 2022, indicating that the economy is at full employment.

–Edward Seiler eseiler@mba.org.