BREAKING NEWS

December Mortgage Credit Availability Hits 8-Month High

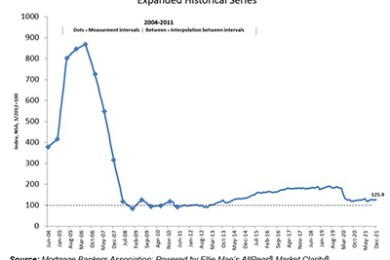

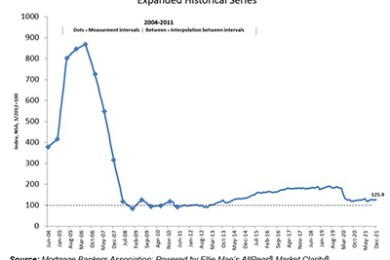

Mortgage credit availability reached its highest level in eight months, the Mortgage Bankers Association reported Tuesday.

MISMO®, the real estate finance industry's standards organization, announced its 2022 Board of Directors.

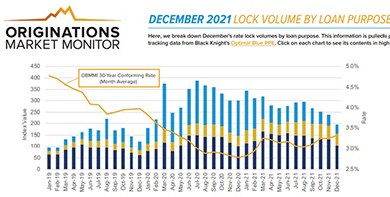

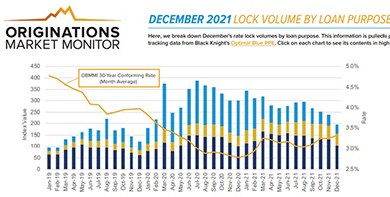

Black Knight, Jacksonville, Fla., said origination activity fell for the fourth straight month in December, with rate lock volume falling to its lowest level in two years.

Green Street, Newport Beach, Calif., said its commercial property price index increased 24 percent in 2021 with robust price appreciation occurring in virtually every corner of the CRE market.

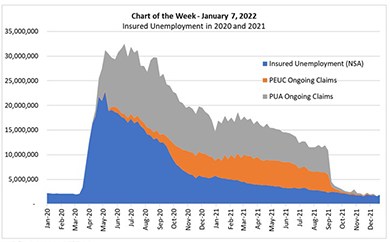

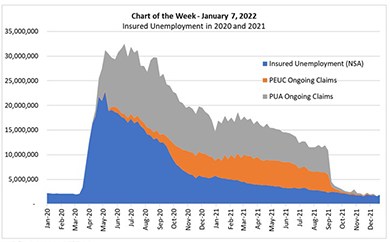

This week’s MBA Chart of the Week highlights the steep rise in insured unemployment at the start of the pandemic (March 2020) and its steady decline through the fall of 2021 as the labor market improved (and related government financial support to households waned).

Castle Mortgage Corp., Newport Beach, Calif., doing business as Excelerate Capital, promoted Thomas Yoon to CEO; he will now serve as CEO and President. Mike Thompson will continue as Board Chairman.

The nomination period for the MBA NewsLink 2022 Tech All-Star Awards is underway with a new, simplified entry form. Nominations will be accepted through Friday, Jan. 21.

Eastern Union, New York, arranged $126 million for multifamily and single-family rental assets in Georgia and Maryland.

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando. Early registration deadline is this Tuesday, Jan. 11--save more than $200 by registering now.

Covius, Denver, integrated Stavvy into its loss mitigation and loan modification platforms. Stavvy is a Boston-based fintech company specializing in eClosing functionality and remote online notary services.

The COVID-19 pandemic presents residential mortgage lenders with an opportunity to expand their role in a critically needed area of community development – advancing affordable homeownership.

Importantly, the SECURE Notarization Act does not replace traditional in-person notarization, which will remain an option for anyone who chooses it. Rather, it simply allows RON as an additional alternative for lenders and consumers. The SECURE Notarization Act preserves and expands consumer choice.

The Home for All Pledge represents our industry's long-term commitment on a sustained and holistic approach to address racial inequities in housing.