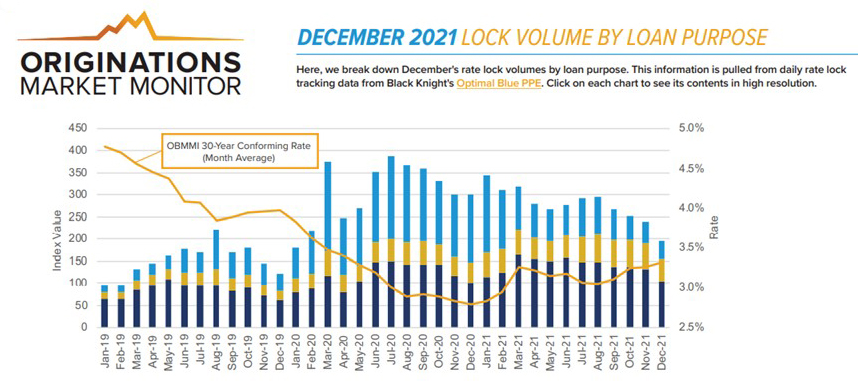

Black Knight: Origination Activity Slows for 4th Straight Month

Black Knight, Jacksonville, Fla., said origination activity fell for the fourth straight month in December, with rate lock volume falling to its lowest level in two years.

The company’s monthly Originations Market Monitor said rate locks fell by 35 percent year over year, resulting from higher interest rates and, even in this unusual period, a “seasonal slowdown” in home purchases. The report said lock volumes fell across the board, driven by a 22.5% drop in rate locks on purchase loans and rate/term refinances falling another 17.1% to finish 2021 at their lowest point since 2019.

The report noted, however, that while locks on cash-out refinance loans also fell (-10%), they were 18% higher from a year ago, as the product remains somewhat insulated by borrowers taking advantage of soaring home equity levels. The refinance share rose to 48% on the decline in purchase locks, with average refi credit scores down 20 points from last year, as higher credit borrowers tend to wait out rising rate environments.

“With the Federal Reserve speeding the tapering of its bond buying and indicating multiple rate hikes in 2022 to curb inflation, 30-year conforming rates sat above 3.3% for much of December,” said Scott Happ, president of Black Knight Secondary Marketing Technologies.

Pipeline data also showed non-conforming loan products continued to gain market share at the expense of agency volumes in December as the average loan amount rose another $4,000 to finish the year at $341,000.

“Seen in the light of the normal seasonal slowdown in home sales as well as our current rate environment, December’s more than 20% drop in purchase loan locks isn’t all that surprising,” Happ said. “Neither was the continued decline in rate/term refinance lending, though the size of the annual decline is noteworthy, if not sobering. While cash-out refi locks were also down for the month, they’re still up nearly 18% from the same month last year as the product remains somewhat insulated by borrowers taking advantage of soaring home equity levels.”