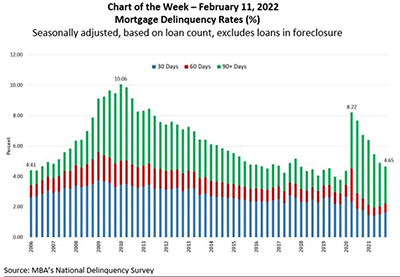

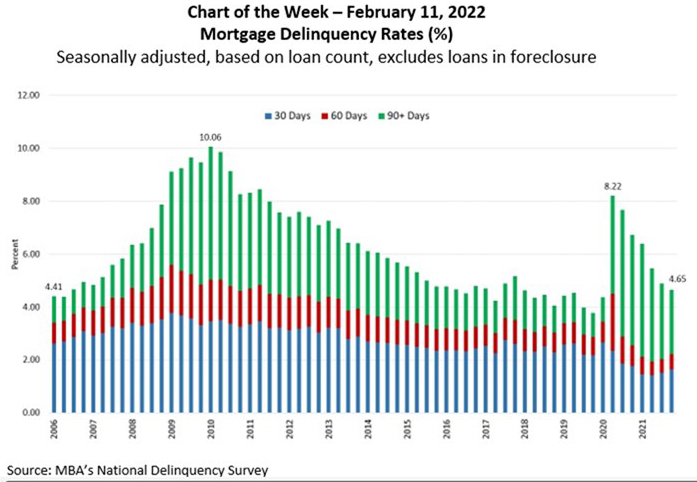

MBA Chart of the Week Feb. 14 2022: Mortgage Delinquency Rates

The Mortgage Bankers Association’s National Delinquency Survey – covering national and state delinquencies through the fourth quarter of 2021 – was released last week.

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.65 percent of all loans outstanding at the end of 2021. The delinquency rate was down 23 basis points from the third quarter and was 357 basis points lower than the pandemic peak of 8.22 percent in second quarter 2020.

The improvement from last quarter was driven entirely by a decline in later-stage delinquent loans – those loans that are 90 days or more past due, but not in foreclosure. This delinquency bucket decreased 41 basis points from third-quarter 2021 to 2.44 percent and dropped 234 basis points from the pandemic peak of 4.78 percent reached in third quarter 2020. Almost all the loans that exited later-stage delinquency found a foreclosure alternative such as a post-forbearance workout; foreclosure starts only rose 1 basis point to 0.04 percent – essentially flat from the survey low seen in third quarter 2021 of 0.03 percent.

Compared to the past quarter, the 30-day delinquency rate increased 14 basis points to 1.65 percent and the 60-day delinquency rate increased 4 basis points to 0.56 percent. That said, both rates were at their lowest levels for any fourth quarter dating back to the start of the survey series in 1979.

– Anh Doan (adoan@mba.org); Marina Walsh (mwalsh@mba.org)