NEWS FOR YOU

FHFA Announces Final Rule Amending Enterprise Regulatory Capital Framework; See Today's MBA Advocacy Update for Details

With Congress in recess this past week, on Thursday the Federal Housing Finance Agency had two major announcements: a long-awaited re-proposal of updates to the capital, liquidity and net worth requirements for servicers; and a final revised capital framework for the GSEs.

ORLANDO—Perhaps the most innovative adaption in the real estate finance industry during the coronavirus pandemic came not from the mortgage industry itself, but from the historically least agile sector—government loan programs.

Pending home sales fell for the third straight month, the National Association of Realtors reported Friday. Despite strong demand, tight supplies continued to hamstring activity.

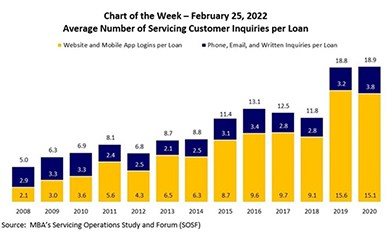

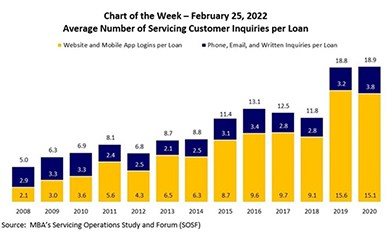

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

Commercial real estate executives remain optimistic despite growing worries about the near future, reported law firm Seyfarth Shaw LLP, Chicago.

Good morning and happy Monday! Here’s what’s happening in the real estate finance world this week:

mPower presents the next in its Career Webinar series, Being You is Your Superpower! on Monday, Feb. 28 from 2:00-3:00 p.m. ET.

Transwestern Real Estate Services, Houston, brokered multifamily and office property sales totaling $18.4 million in suburban Sacramento, Calif. and Milwaukee, Wis.

MISMO®, the real estate finance industry standards organization, seeks public comment on updates to MISMO Engineering Guideline 7, which establishes class words that enable consistency in naming and structure of data point names.

For nearly two decades, creating a completely digital process from application to the secondary market has been one of the mortgage industry’s greatest, most exciting and most difficult challenges. The eMortgage remains an elusive goal—but today we’re closer to it than ever.

A lender committed to DEI focuses on building staff, leadership and a customer base that reflect the borrowers it wants to serve. Diverse staff and leadership create an environment where a broader range of ideas can flourish, boosting a company’s bottom line.

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.

The Mortgage Bankers Association's Secondary & Capital Markets Conference & Expo returns to the Marriott Marquis in Times Square, New York City, from May 15-18.