Mark P. Dangelo: 2023: We Who are About to Die Salute You!

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Across the mortgage industry, the last year has been defined by unanticipated shifts with consumers, across strategy, and most importantly for bankers, a loss of profitability against traditional processes and practices. With 2023 now a month away, leadership personnel continue to explore and research advancements in FinTech and RegTech software, cloud solution efficiencies and staffing realignments. The hope is that “something” will provide a cure for the growing, challenging ailments.

With prosperity tied to rising interest rates and rapid volume declines in refi’s (down nearly 70% in 12 months), the weekly headlines carry layoffs of hundreds and sometimes thousands of workers. Even the euphemistic “voluntary separation” is back with firms offering 8% to 15% of their workforces benefits to retire. As 2023 arrives and the @FederalReserve is set to continue their rate increases, mortgage professionals will find themselves in a situation they have not witnessed since 2009.

Factor in 2023 market origination projections contracting up to 50% of 2021 levels, and the staffing expansion of 2019-2021 may linearly decline from their 2021 peaks (>400K) to deal with volume decay. To combat the contractions, IT and business leaders are seeking improvements using digital efficiencies, yet their greatest “ask” is a remedy for reducing the 75% of data budgets which are spent on cleaning, manipulating, and replicating data for system activities.

Factor in the impacts to staffing models (which rose over 40% during the last five years) against innovation advancements and the reimaging of the 80+ distinct mortgage processes, the industry outlook is primed for a comprehensive restructuring. Additionally, with 3,500 industry players, the top three lenders each possessing 7% to 11% market share, and the consolidation of commodity products across cloned business models, current operating approaches are balanced on the knifes edge of comprehensive disruption.

As 2023 dawns, what should industry leaders do to improve operating margins? What solutions will yield efficiencies? Are there “phase shift” approaches, innovations, or vendor consolidations that will deliver forward looking realizations representing a pivot from asset foci to decentralized, sovereign data designs? There are dozens more questions, but we will focus on three building blocks that will resonate across business models and customer approaches—partnerships and outsourcing, next-gen #FinTech and #RegTech, and emerging data fabric implementations. Their efficacy will be a direct result of corporate cultures, perceived risks, transformation ability and next-generation competitive strategies.

Partnerships and Outsourcing

This proven “go-to” approach for financial and mortgage leaders was instrumental in weathering the expansions and contractions since the #GreatRecession (e.g., 2008 to present). Using a combination of #ITO and #BPO designs, processes, and technologies, linkages and value-added solution sets have allowed smaller to medium sized mortgage operators to rapidly increase scale and quality of loans.

Spanning the mortgage supply chain starting at customer contact to origination to underwriting to servicing to securitization, partners and outsourcers have grown substantially not only in size, but also across the complexity of their capabilities. Noted providers and vendors such as @Wipro, @SLKGlobal, @ICE, and @Sutherland dominate the space, but others driven by career industry professionals include @Privocorp and @VerityGlobal with each offering distinctive choices, bespoke alignments, and price points.

What remains to be determined, is can prior collaborative third-party arrangements (e.g., cooperatives, shared services) and mortgage outsourcers thrive during a 50% volume contraction? How will their margins and service levels adjust to the new customer and processing realities? Additionally, how will mortgage bankers and processing groups adjust these existing operating conditions to meet variability in governance, oversight, and auditability? While these operating building blocks have been viewed as minimal risk given their breadth and subscribers, the parameters and requirements have altered the outputs and downstream interfaces.

Therefore, while this solution for 2023 of using a familiar efficiency approach provides operational consistency, it is the relevancy of the approach that now should be examined. Those partners and outsourcers that are nimble and offer granular capabilities to meet industry standards and requirements will grow, while they secure runway for likely phase shifts in the business models of their clients and their own organization.

In the end, this building block will be useful—but in limited circumstances when applied to emerging sovereign data ecosystems, trusted decentralized data assets, and natively digital consumers. Moreover, as investors demand asset classes and instruments that are comprehensively backed by robust, immutable, crosslinked systems of record (#SOR), the siloed approaches within FinTech and RegTech software solutions commonly solved by point-based functionality will lose usefulness as their reconciliation and ingestion processes create cumbersome API’s and data pipelines which cannot scale.

Next-Gen FinTech and RegTech

The next-gen technology is wrapped in adjectives and phrases of “exciting,” “reshaping,” “breakthrough,” and even “all-in-one.” In 2021, there were over 5,500 investments that were placed into these existing and next-gen FinTech’s and RegTech’s totaling nearly $250 billion USD. For financial services and mortgage leaders, these innovative investments have provided pathways to productivity and efficiencies during the last decade of volume and concentrations on risk avoidance and asset quality.

Yet are these incremental iterations enough when mapped against native digital consumers on one end of the continuum and investors demanding linked, real time digital information? Today as organizations struggle with the impacts and outcomes of continuous digital transformations, the criticality discrete data assets cannot be isolated using siloed software housed within corporate boundaries or hybrid clouds. The ability to reuse data, immutable and sovereign, allows organizations to significantly reduces costs while delivering consistency and auditability.

Next-gen technologies are delivered within #XaaS (anything as a service) architectures. The traditional, bolt-on solutions that encased discrete mortgage systems (e.g., LOS, servicing, underwriting) are transforming into embedded, crosslinked offerings using common data assets implemented through standardized data science schemas and elements.

This movement of FinTech and RegTech transitioning into embedded solutions which are leveraged across silos (see @McKinsey), may reach over $7 trillion USD annually during the next decade. The stakes to unlock and streamline digital assets have never been greater when analyzed against trends that show over 60% of the data currently captured within these high-tech solutions is never accessed.

Within this changing context, mortgage firms are familiar with the traditional. There are existing relationships, #ETL (extraction, transformation, and load) mappings, skills and training resources, and cross-vendor linkages that can be called upon to improve internal or external capabilities. However, as existing technologies are compared against emerging solutions, the gaps between “as-is” and “to-be” are growing especially when applied against native digital consumers and their expectations.

As embedded FinTech and RegTech become the norm for struggling lenders, the impacts to their operating models will be pronounced and permanent. At a time of negative per loan profitability, the demands for investment will have to be measured against competitive advantage, downstream benefits with data insights, and expansive customer contact and retention.

This changes not only the approaches for implementations, but also the business models and benefits that have provided profitability during the last 13 years. Moreover, just as these next-gen technologies arrive, the once abstract idea of an enterprise data fabric is now being used as the underlying infrastructure to link these embedded solutions at the “speed of digital.”

Abstract Data Fabrics Made Real

If we examine the digital strategies of some of the largest software vendors supporting the mortgage industry, taking a critical eye on their seemingly piecemeal competitive acquisitions, we can deduce that these events were not just about market share—but were designed to create a data fabric that links SOR’s from start to finish. For many the idea of data standards is the same thing as a data fabric or mesh—they are different. Fabrics and meshes use standards to crosslink not just systems, but also deliver immutable insights, discovery, and decisioning that improves advancing AI and ML capabilities.

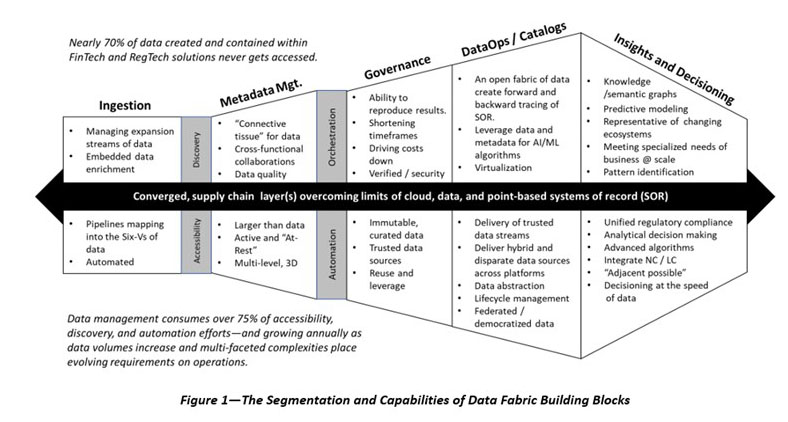

Data fabrics, when examined against industry requirements and technological advancements, will be the overlay used to meet the changing digital behaviors pushed by both the mortgage customer and the investor community. What transpires between these two constituents is why data fabrics are becoming the hottest topic in boardrooms and across IT communities. The data science promises and hype have real world use cases when applied to the process fragmentation and readily available FinTech and RegTech solution silos (see Figure 1).

For those unfamiliar with data fabrics and the science they bring to businesses, they are implemented using a combination of existing products and capabilities (of note see @IBM, @Denodo, @HPE). Proven results, ROI, and use cases can be found from research organizations that include @Gartner and @Forrester.

In Summary

The mortgage industry, its investors, and those innovators seeking to disrupt markets are facing a trifurcation; 1) seek marginal efficiencies to stay in business, 2) applying FinTech and RegTech against traditional business models, or 3) reimage the supply chain of mortgage delivery to align with the native digital consumer. The extensions of items 1 and 2 deliver augmented approaches of familiar, commodity solutions, which are increasingly marginalized as they are easily replicated by competitors.

The third option creates the best upside in 2023-2025 for mortgage bankers and their customers, but it also represents the greatest set of phase shifts and challenges—abstraction, risks, upskilling, and digital trust. In option 3, this is where the demand and value proposition for data fabrics creates a solution for success, but requires a reskilling and mindset shift from what traditional mortgage banking involves and can deliver to customers and investors. The processes and technologies between these endpoints are where the opportunities reside when reimaging the industry using methods such as #Agile and #SixSigma. Technologies such as #blockchain are just that—part of technology stacks enabling a solution, not the solution or business drivers.

Finally, one other common thought likely crossing the minds of industry leaders and pushed by traditional consultants will be M&A actions—but this strategy within an industry in comprehensive transition will be expensive and lead to career ending mistakes for many lured into believing this is just a “normal industry cycle.” M&A to “buy” customer lists and minimal technology will be facing diminishing returns as the time to integrate and bring “online” will miss targets and participation in these evolving digital ecosystems. Nonetheless, the damage will be extensive as pundits recycle irrelevant strategies.

The arrival of 2023 represents the next-generation phase shift that will begin to unveil what the reimaged mortgage industry will become. The opportunities and challenges will be for traditional leaders who have grown accustomed to this 13-year cycle of profitability to adapt—or die. Ask yourself, who were the brand and market leaders before the Great Recession? Where are they now? Can the lessons learned and playbooks of history teach us how to adapt for the next-cycle that is already underway? The three approaches above offer guardrails—yet now is the time to act.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)