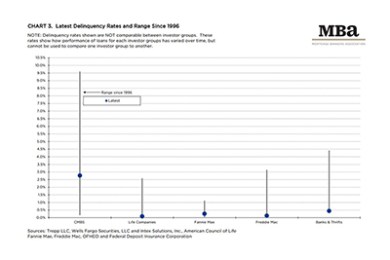

MBA: 3Q Commercial/Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies showed little movement in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

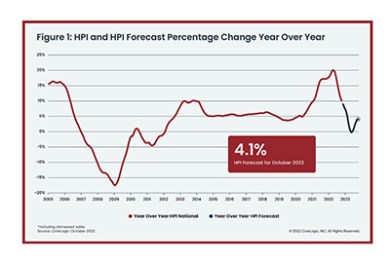

CoreLogic: Annual Home Price Growth Slows to Half of Spring Peak

CoreLogic, Irvine, Calif., said year-over-year home price growth remained in double digits in October, at 10.1%, but continued to cool and was the lowest recorded since early 2021.

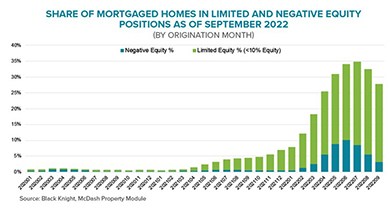

Black Knight: 8% of 2022 Mortgaged Home Purchases Underwater; FHA Loans See Early-Payment Defaults Rise

Black Knight, Jacksonville, Fla., said of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans.

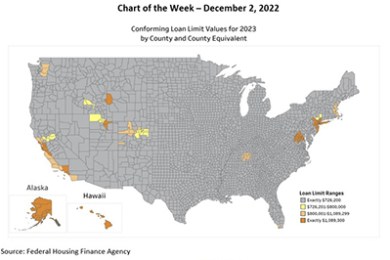

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

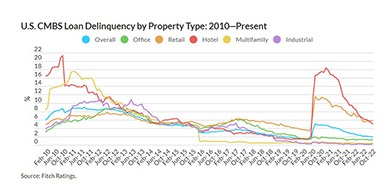

CMBS Delinquency Rate Dips; Forecast Calls for 2023 Increase

Fitch Ratings, New York, said the commercial mortgage-backed delinquency rate fell six basis points in October to 1.89%, but forecast it could increase significantly in 2023.