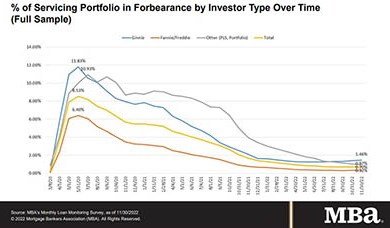

MBA: November Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance remained flat at 0.70% as of November 30. MBA estimates 350,000 homeowners are in forbearance plans.

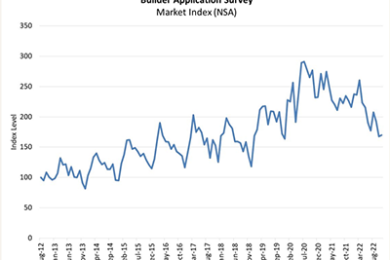

November New Home Purchase Mortgage Applications Up 1%

The Mortgage Bankers Association’s November Builder Applications Survey reported mortgage applications for new home purchases rose by 1percent from October, but fell by 25.2 percent from a year ago.

MBA, Trade Groups Urge FTC to Crack Down on Banking Scams

The Mortgage Bankers Association, the American Bankers Association and other banking trade associations urged the Federal Trade Commission to crack down on those who impersonate banks or government officials in scams.

Builder Confidence Down 12<sup>th</sup> Straight Month

The National Association of Home Builders/Wells Fargo Housing Market Index went 12-for-12 in 2022—but not in a good way.

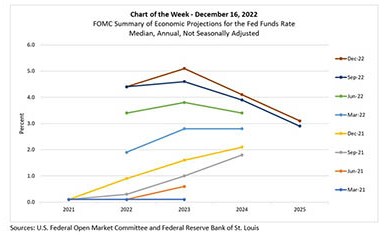

MBA Chart of the Week Dec. 16, 2022: Federal Funds Rate Projections

In an effort to increase transparency after the Great Recession, one of the Federal Open Market Committee communication initiatives under Chairman Ben Bernanke was to publish individual members’ assessments of the economy in the Summary of Economic Projections. In this week’s MBA Chart of the Week, we track changes in policymakers’ quarterly published SEP forecasts of the federal funds rate over the past eight quarters.

Dealmaker: Comstock, Berkadia Secure $78M Refinancing

Comstock Holding Cos., Reston, Va., jointly structured a 10-year, 4.5% fixed-rate $77.5 million loan with Berkadia Commercial Mortgage, New York, to refinance Phase II of Comstock’s Loudoun Station in northern Virginia.