Ahead of MBA Survey, Reports Show Drops in Delinquencies, Foreclosures

Ahead of this Thursday’s release of the quarterly MBA National Delinquency Survey, reports from CoreLogic, Irvine, Calif., and ATTOM, Irvine, show declines in both mortgage delinquencies and foreclosure activity.

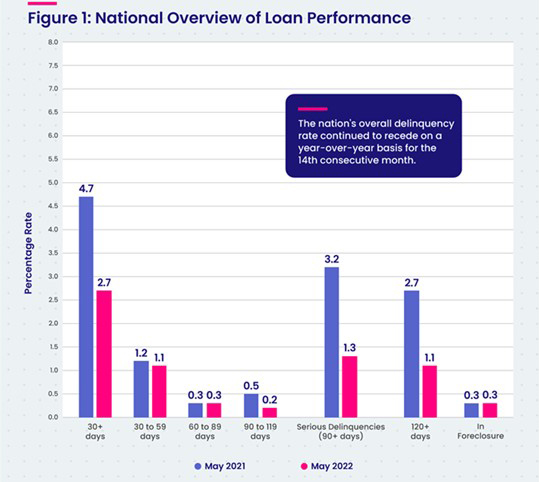

The monthly CoreLogic Loan Performance Insights Report showed in May, 2.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 2 percentage point decrease compared to 4.7% a year ago.

The report said Early-Stage Delinquencies (30 to 59 days past due) fell to 1.1%, down from 1.2% a year ago. Adverse Delinquencies (60 to 89 days past due) were unchanged at 0.3%. Serious Delinquencies (90 days or more past due, including loans in foreclosure) fell to 1.3%, down from 3.2% a year ago and a high of 4.3% in August 2020.

The Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process) was unchanged at 0.3% from a year ago. The transition Rate (the share of mortgages that transitioned from current to 30 days past due) fell to 0.6%, down from 0.7% a year ago.

The U.S. overall mortgage delinquency rate declined for the 14th consecutive month on an annual basis in May to the lowest level recorded since January 1999. While the national foreclosure rate remained flat year over year and month over month, the rate did have a small monthly uptick in March of this year. However, it too remains near a historic low. As in previous months, home price growth and the resulting equity accumulation helped keep foreclosure rates low in May, with year-over-year appreciation topping 20% this spring.

“Early-state mortgage delinquencies are at a generational low supported by a strong labor market,” said Molly Boesel, principal economist at CoreLogic. “Furthermore, serious delinquencies have declined to where they were in early 2020. While the foreclosure rate remains low, about half of serious delinquencies are from mortgages that are six months or more past due. This suggests that there could be small increases in the foreclosure rate later this year.”

The report said all states posted annual declines in their overall delinquency rates. States with the largest declines were Nevada (down 3.2 percentage points), New York, New Jersey and Hawaii (all down 3.1 percentage points). All other states, including the District of Columbia, registered annual delinquency rate drops between 3 percentage points and 0.9 percentage points.

All U.S. metro areas posted at least a small annual decrease in overall delinquency rates, with Odessa, Texas (down 5.6 percentage points), Kahului-Wailuku-Lahaina, Hawaii (down 5.1 percentage points) and Laredo, Texas(down 4.8 percentage points) posting the largest decreases.

Separately, the ATTOM July U.S. Foreclosure Market Report noted 30,358 U.S. properties with foreclosure filings, down 4 percent from a month ago but up 143 percent from a year ago.

“While it’s encouraging to see both foreclosure starts and completions drop off a bit in July, it’s also worth noting that there may be some seasonality impacting the numbers,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “In eight of the last 10 years Q3 foreclosure activity has been lower than the previous quarter, so we might just be seeing a return to a more normal seasonal pattern of delinquencies and defaults.”

ATTOM reported nationwide, one in every 4,628 housing units had a foreclosure filing in July. States with the highest foreclosure rates were Delaware (one in every 2,127 housing units); Illinois (one in every 2,334 housing units); New Jersey (one in every 2,564 housing units); Nevada (one in every 2,609 housing units); and South Carolina (one in every 2,976 housing units).

Among 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in July were Elkhart, Ind. (one in every 1,592 housing units); Davenport, Iowa (one in every 1,626 housing units); Fayetteville, N.C. (one in every 1,673 housing units); Cleveland, Ohio (one in every 1,757 housing units); and Atlantic City, N.J. (one in every 1,886 housing units).

ATTOM reported lenders started the foreclosure process on 21,428 U.S. properties in July, down 4 percent from last month but up 226 percent from a year ago.

“It appears that a few states are still catching up on processing foreclosures on loans that were seriously delinquent prior to the pandemic, which accounts for the year-over-year spike in foreclosure starts,” Sharga said. “But early-stage delinquencies continue to be lower than normal, so once these older loans have re-entered the foreclosure process, it will be interesting to see if foreclosure starts fall off significantly.”

ATTOM said lenders repossessed 3,068 U.S. properties through completed foreclosures (REOs) in July, down 5 percent from last month but up 27 percent from last year.

MBA releases its 2nd Quarter National Delinquency Survey this Thursday, Aug. 11. The NDS covers more than 39 million loans on one- to four- unit residential properties. Loans surveyed were reported by nearly 90 lenders, including independent mortgage companies, and depositories such as large banks, community banks and credit unions.