BREAKING NEWS

Applications Rise for 2nd Straight Week in MBA Weekly Survey

Mortgage applications rose for the second straight week despite continued interest rate volatility, the the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 5.

Ahead of this Thursday’s release of the quarterly MBA National Delinquency Survey, reports from CoreLogic, Irvine, Calif., and ATTOM, Irvine, show declines in both mortgage delinquencies and foreclosure activity.

The Conference of State Bank Supervisors on Tuesday released two new tools for nonbank financial services companies to improve their cybersecurity posture.

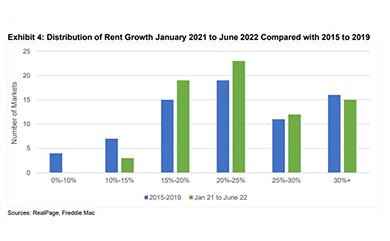

After six months of healthy growth in multifamily fundamentals, Freddie Mac, McLean, Va., said the sector’s growth could moderate through the remainder of 2022.

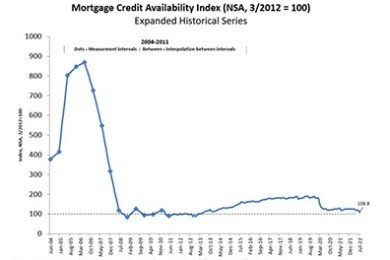

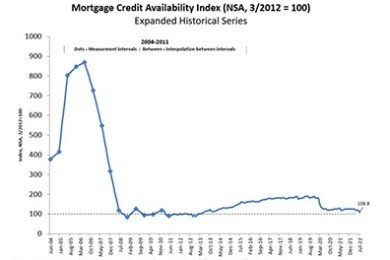

Mortgage credit availability fell for the fifth straight month in July to its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

TransUnion, Chicago, said the first half of 2022 concluded with a normalization in serious delinquency rates to pre-pandemic levels for most credit products as lenders continued to expand access to credit cards and personal loans.

Northmarq’s San Francisco office secured $46 million to refinance a three-property multifamily portfolio in Pleasanton, Calif.

Lenders with an eye for success will need to rely on strong referral partnerships as the mortgage market cools, stiffening competition for leads and loans. Simply put, the key to referral partnerships is to aim for quality, not quantity.

When the mortgage industry is in a constant state of change, it's important for lenders to stay on top of their game. With new reports coming out every day about market dynamics, competitive pressures, supply shortages and the persisting economic impacts of the global pandemic – mortgage lenders may be seeking ways to remain profitable and compliant.

According to a 2019 McKinsey study, lack of production data is the number one cause of poor hiring decisions across the mortgage industry.

Reimaging of the mortgage markets has begun—driven by shrinking margins, rising rates, and inflationary pressures. Yet, for all the actions since 2010 involving data standards, digital transformations, and customer experiences, what is missing? Who will be left standing as the next cycle takes form and the mortgage industry is digitally reimaged?

Lenders that hunkered down during the last two major industry downturns are no longer in the business, while those that leaned in and innovated during the same period emerged as industry leaders. Now is not the time for timidity. In fact, leading lenders are leaning into innovation now. There are at least three good reasons to do so.

Former House Speaker Paul Ryan, R-Wis., keynotes the Opening General Session at the Mortgage Bankers Association's Annual Convention & Expo on Monday, Oct. 24 at 8:30 a.m. CT.