July Consumer Prices Stabilize; Rise 8.5% Annually

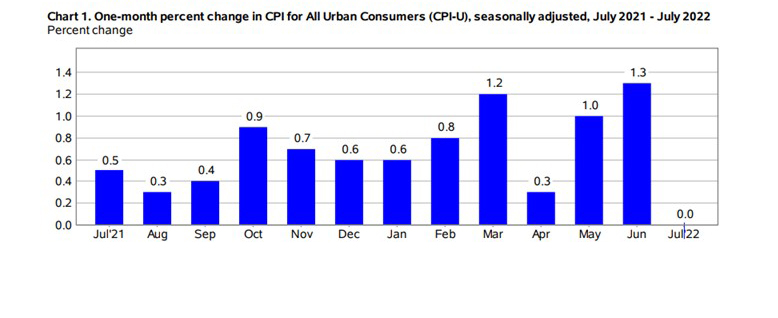

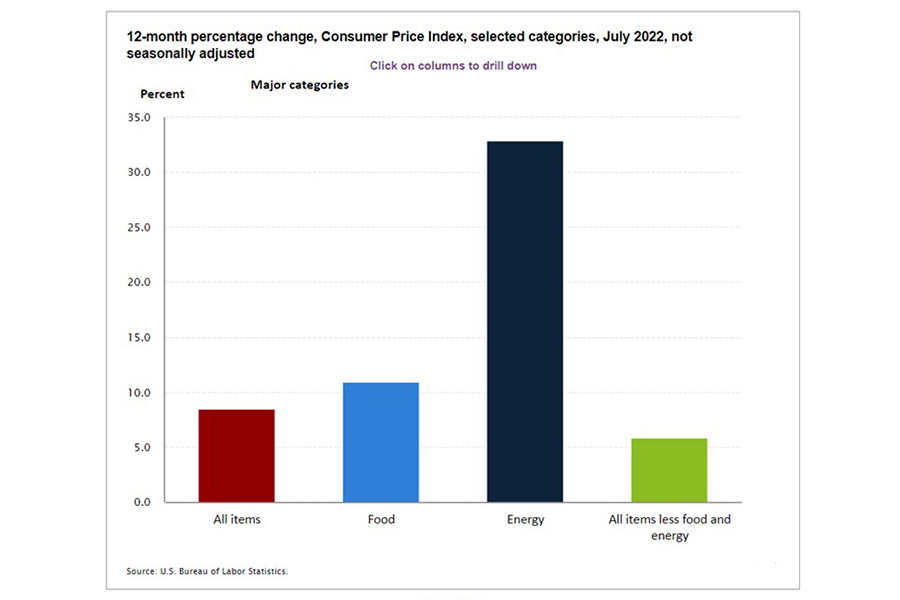

The Consumer Price Index, a closely watched measure of inflation, was unchanged in July on a seasonally adjusted basis after rising 1.3 percent in June, the Bureau of Labor Statistics reported Wednesday. Over the past 12 months, the all-items index increased by 8.5 percent before seasonal adjustment.

Energy prices contributed to the stabilization. The gasoline index fell 7.7 percent in July and offset increases in the food and shelter indexes, resulting in the all-items index being unchanged over the month. The energy index fell 4.6 percent over the month as the indexes for gasoline and natural gas declined, but the index for electricity increased. The food index continued to rise, increasing 1.1 percent over the month as the food at home index rose 1.3 percent.

The index for all items less food and energy rose by 0.3 percent in July, a smaller increase than in April, May, or June. The indexes for shelter, medical care, motor vehicle insurance, household furnishings and operations, new vehicles, and recreation were among those that increased over the month. Some indexes that declined in July, including those for airline fares, used cars and trucks, communication, and apparel.

The all-items index increased by 8.5 percent for the 12 months ending July, a smaller figure than the 9.1-percent increase for the period ending June. The all-items less food and energy index rose by 5.9 percent; the energy index increased by 32.9 percent, a smaller increase than the 41.6-percent increase for the period ending June. The food index increased by 10.9 percent over the past year, the largest 12-month increase since the period ending May 1979.

“Consumer price inflation surprised to the downside in July, with the headline index flat over the month and core prices rising 0.3%,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Falling prices for gasoline, used autos and travel service categories such as airline fares, car rentals and lodging away from home helped cool monthly inflation from the torrid pace seen in May and June.”

House noted unlike the previous two CPI reports, the July CPI release provides some welcome news for members of the Federal Open Market Committee, which has made curbing inflation its major priority. “That said, monetary policymakers have made clear that they need to see clear evidence of a sustained slowdown in inflation before pivoting on monetary policy,” she said. “To that end, core CPI is still up 5.9% year-over-year and has grown at a 6.8% annualized pace over the past three months. In our view, it will take several more soft inflation prints before the FOMC begins to feel confident that it is getting price pressures in check. At least a 50 basis-point rate hike at the September FOMC meeting remains the most likely outcome.”