BREAKING NEWS

Mortgage Applications Fall in MBA Weekly Survey

The highest mortgage rates in more than a decade pushed mortgage application activity down, the the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 15.

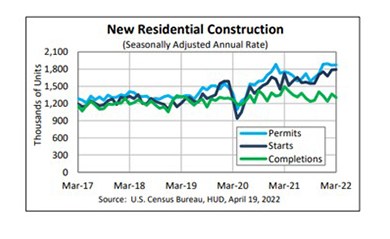

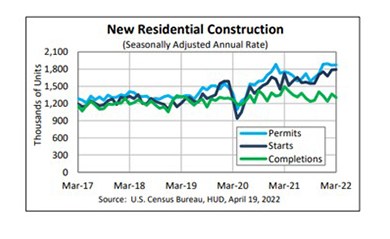

Housing starts improved slightly in March, thanks to a bump in multifamily starts, HUD and the Census Bureau reported Tuesday.

MISMO®, the real estate finance industry standards organization, seeks public comment on a standardized questionnaire for borrowers to answer when applying for a commercial mortgage loan.

The Federal Housing Finance Agency last week released its 2022-2026 Strategic Plan for Fiscals Years 2022-2026, focusing guiding Fannie Mae, Freddie Mac and the Federal Home Loan Bank System for the next five years.

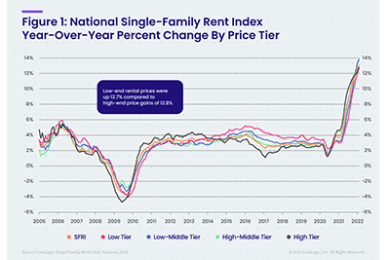

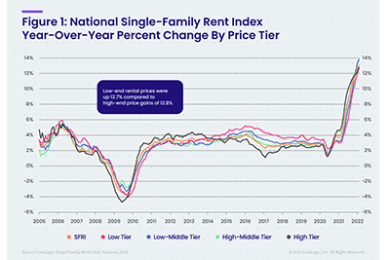

CoreLogic, Irvine, Calif., said single-family rent growth continued its double-digit gains in February, rising 13.1 percent year-over-year.

FHLBank San Francisco is a member-driven cooperative helping local lenders in Arizona, California and Nevada build strong communities, create opportunity and change lives for the better.

Blackstone, New York, agreed to acquire student housing real estate investment trust American Campus Communities, Austin, Texas, for $12.8 billion, including assuming ACC debt.

NewPoint Real Estate Capital LLC, Plano, Texas, provided $157.9 to Bard Investment Co. to refinance a four-property multifamily portfolio in Arizona.

Traditionally, when this market flip occurs, intense pressure is bestowed upon lender sales and marketing teams. Everyone looks for them to become the ‘rainmakers.’ Pressures are often proportionate to the size of the lender, because few big banks invest in local purchase market referral relationships year-round. There is a fresh new approach to supplement the lender playbook, both at the enterprise and loan officer level.

Join mPact--the MBA group focused on mortgage professionals ages 35 and under--for a series of networking events during the upcoming MBA National Advocacy Conference in Washington, D.C.

Mortgage loan officers can no longer rely on bargain rates and that means they need to work harder than ever to best the competition. So how does a loan officer stand out? It’s all about social media.

At this year’s National Advocacy Conference, which takes place April 26-27 in Washington D.C., MBA is coordinating with association partners and members to encourage Congress to cosponsor and support the passage of the Securing and Enabling Commerce Using Remote Online Notarization Act (SECURE Notarization Act) of 2021.

The Mortgage Bankers Association's State and Local Workshop 2022 takes place Apr. 25-26 at the Renaissance Downtown Hotel in Washington, D.C., just ahead of the MBA National Advocacy Conference.