BREAKING NEWS

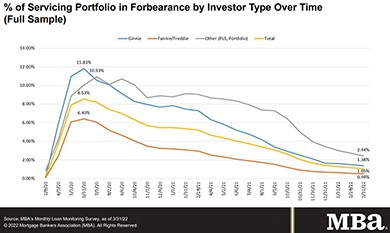

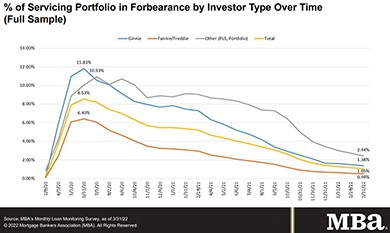

Loans in Forbearance Fall to 1.05%

Loans in forbearance fell to another pre-pandemic low to just barely above 1%, the Mortgage Bankers Association reported Monday.

Rapidly rising interest rates, combined with ongoing home price increases and higher construction costs, continue to take a toll on builder confidence and housing affordability, the National Association of Home Builders reported Monday.

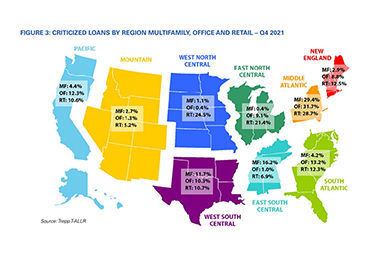

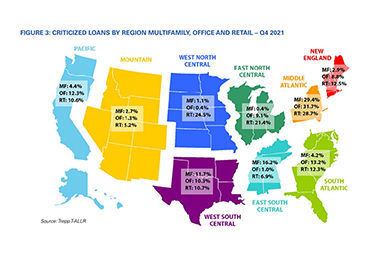

Trepp, New York, reported bank commercial real estate originations rebounded in late 2021 while delinquencies continued to trend down after a moderate rise in 2020.

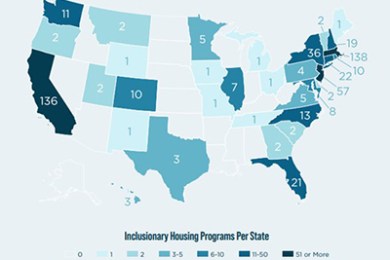

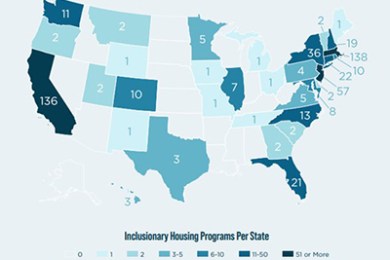

A study by a Mortgage Bankers Association-supported member network suggests an optimal mix of incentives and requirements could help policymakers avoid polarizing private sector and community stakeholder groups while working toward the goal of increasing affordable housing production.

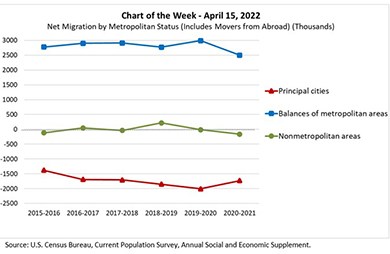

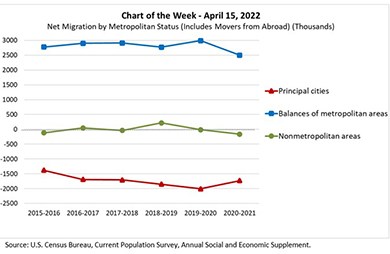

MBA Chart of the Week shows net migration by metropolitan status from spring 2015 to spring 2021. The most recent 2020-2021 data allows us to examine moves during the first year of the pandemic, and to see if, as widely reported, there was accelerated movement out of cities to the suburbs (or even further afield) compared to the five years prior to COVID-19.

FHLBank San Francisco is a member-driven cooperative helping local lenders in Arizona, California and Nevada build strong communities, create opportunity and change lives for the better.

Hilco Real Estate LLC, Northbrook, Ill., brokered hotel sales in Alabama and Tennessee totaling $27 million.

Wells Fargo, San Francisco, announced an initiative to help advance racial equity in homeownership. The company will develop a Special Purpose Credit Program to help minority homeowners, whose mortgages are currently serviced by Wells Fargo, refinance those mortgages. Initially, through the program, Wells Fargo will identify eligible Black homeowners who could benefit from a refinance product.

Mortgage loan officers can no longer rely on bargain rates and that means they need to work harder than ever to best the competition. So how does a loan officer stand out? It’s all about social media.

Join mPact--the MBA group focused on mortgage professionals ages 35 and under--for a series of networking events during the upcoming MBA National Advocacy Conference in Washington, D.C.

At this year’s National Advocacy Conference, which takes place April 26-27 in Washington D.C., MBA is coordinating with association partners and members to encourage Congress to cosponsor and support the passage of the Securing and Enabling Commerce Using Remote Online Notarization Act (SECURE Notarization Act) of 2021.

Total commercial and multifamily mortgage borrowing and lending is expected to hold steady at a projected $895 billion in 2022, roughly in line with 2021 totals ($891 billion), the Mortgage Bankers Association said Monday.

My favorite thing about starting NAMMBA has got to be all people I get to meet every day. And the annual CONNECT Event? It fills my cup and reminds me that I’m a part of something bigger than myself.