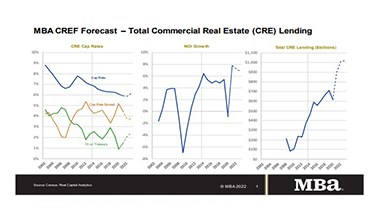

MBA Forecast: Commercial/Multifamily Lending Holds Steady Amid Higher Rates, Economic Uncertainty

Total commercial and multifamily mortgage borrowing and lending is expected to hold steady at a projected $895 billion in 2022, roughly in line with 2021 totals ($891 billion), the Mortgage Bankers Association said Monday.

MBA Advocacy Update Apr. 18, 2022

Last week, MBA responded to the CFPB’s RFI on fees – both in a comment letter and in a joint trades comment letter – imposed by providers of consumer financial products and services. Also last week, MBA sent a letter to FHFA and the GSEs outlining concerns regarding the GSEs’ temporary condominium requirements on deferred maintenance and structural integrity for condo and co-op projects.

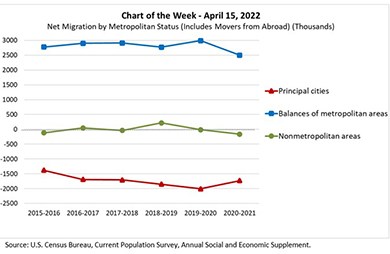

MBA Chart of the Week Apr. 15, 2022: Net Migration by Metropolitan Status

MBA Chart of the Week shows net migration by metropolitan status from spring 2015 to spring 2021. The most recent 2020-2021 data allows us to examine moves during the first year of the pandemic, and to see if, as widely reported, there was accelerated movement out of cities to the suburbs (or even further afield) compared to the five years prior to COVID-19.

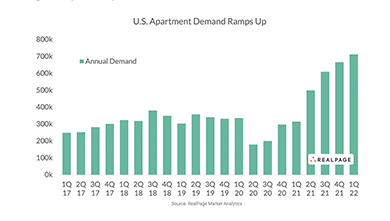

Apartment Demand, Rent Growth Reach New Highs

The apartment market reached record highs for demand, occupancy and rent growth in the first quarter--toppling previous multi-decade peaks set last year, reported RealPage, Richardson, Texas.

#MBATech2022: How Trends Intersect in a Changing Industry

LAS VEGAS—Real estate finance has migrated quickly from a person-to-person business to a person-to-tech-device-to-person business. And socio-economic forces are rapidly steering technology to reshape business—even as business continues to fine-tune technology.