BREAKING NEWS

Loans in Forbearance Fall Under 3 Percent

Loans in forbearance fell to under 3 percent for the first time since March 2020, the Mortgage Bankers Association reported Monday.

Here’s a roundup of recent housing reports that have come across the MBA NewsLink desk:

The pandemic and market pressures are forcing the retail sector to innovate, reported Colliers, Toronto.

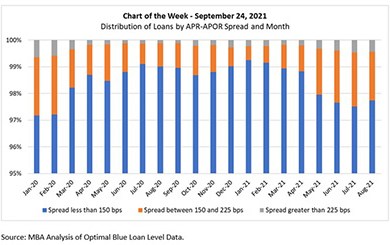

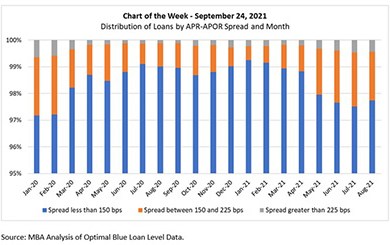

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

On Tuesday, House lawmakers passed a continuing resolution along party lines, sending the measure to the Senate for a vote ahead of a Sept. 30 government funding deadline. Meanwhile, MBA led a coalition of associations urging Congress to raise the federal debt limit to avoid roiling financial markets. And MBA’s Research Institute for Housing America released a report that examines climate change’s growing impact on housing and housing finance.

Discover five common scenarios in mortgage lending to help your enterprise get started with machine learning.

Blackstone Real Estate Partners VII LP, New York, agreed to sell The Cosmopolitan of Las Vegas for $5.65 billion.

CBRE, Dallas, appointed Rachel Vinson as Global Chief Operating Officer for Capital Markets. She lead the operations of CBRE’s global Capital Markets business, consisting of Property Sales, Debt & Structured Finance and Capital Advisors—the firm’s investment banking division.

By combining multiple advanced technologies such as machine learning and RPA, businesses are innovating their workflows. Lending solutions is a prime area where hyperautomation can deliver significant benefits and accelerate the speed of growth.

Kim Betancourt is Fannie Mae’s Senior Director of Economics and Multifamily Research. She manages a team of real estate economists that focus exclusively on the multifamily sector.

With the effects of the pandemic now stretching into a second year, many mortgage companies are beginning to feel the pressure to have employees return to the office. However, while returning may seem like the right move on the surface, it is important to consider the reasoning behind this decision and whether it is completely necessary.

Data is the “dark matter” of M&A events. Data is made even more important with widespread digital transformations of processes, predictive analytics, and advanced machine learning. During an M&A event, the cascading challenges to leverage these siloed data innovations across Industry 4.0 ecosystems requires a framework that moves beyond the prescriptive, one-size-fits-all strategy.

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).