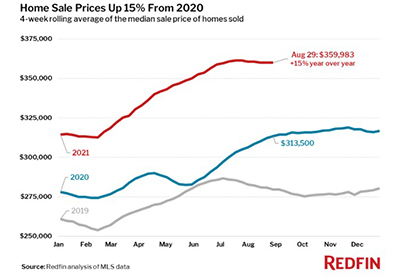

Home Prices Up 15% from Year Ago, But Taking Longer to Sell

Yet another report this week shows U.S. home prices with double-digit percentage annual home price gains, although not nearly as dramatic as earlier reports. And, said Redfin, Seattle, pending sales are slowing and homes are taking longer to sell—and sellers are taking notice by slashing their asking prices.

For the four-week period ending August 29, Redfin reported the median home-sale price increased 15% year over year to $359,983. Asking prices of newly listed homes rose by 10% from the same time a year ago to a median of $354,665—the lowest level since late April and down 1.8% from the record high set during the four-week period ending June 27.

Redfin Chief Economist Daryl Fairweather said more home sellers have started slashing their prices—another sign of softening seasonal homebuyer demand.

“The housing market has clearly become slightly more favorable to buyers,” Fairweather said. “Homes are taking longer to sell, which gives buyers more time to make thoughtful decisions about whether to make offers. Home prices have plateaued, so buyers shouldn’t feel rushed to buy before prices rise further. And the fact that more sellers are dropping their list price is a sign that sellers have to be realistic about their price expectations.”

Other report findings through Aug. 29:

• New listings of homes for sale were nearly flat (-0.1%) from a year earlier. The number of homes being listed is in a typical seasonal decline, down 10% from the 2021 peak reached during the four-week period ending June 27.

• Active listings (the number of homes listed for sale at any point during the period) fell 22% from 2020. Active listings were up 17% from their 2021 low set during the four-week period ending March 7, but have declined 1% from their 2021 peak hit during the four-week period ending August 8.

• 48% of homes that went under contract had an accepted offer within the first two weeks on the market, above the 44% rate of a year earlier, but down 8 percentage points from the 2021 peak set during the four-week period ending March 28.

• 35% of homes that went under contract had an accepted offer within one week of hitting the market, up from 32% during the same period a year earlier, but down 8 percentage points from the 2021 peak reached during the four-week period ending March 28.

• Homes that sold were on the market for a median of 18 days, up from the record low of 15 days seen in late June and July, and down from 33 days a year earlier.

• 51% of homes sold above list price, up from 32% a year earlier. This measure has been falling since the four-week period ending July 11, when it peaked at 55%.

• On average, 5.1% of homes for sale each week had a price drop, up 1 percentage point from the same time in 2020, and the highest level since the four-week period ending October 13, 2019.

• The average sale-to-list price ratio decreased to 101.5%. This measure was down 0.7 percentage points from its peak hit during the four-week period ending July 11 and up 2.3 percentage points from a year earlier.