Initial Claims Swing Back Lower

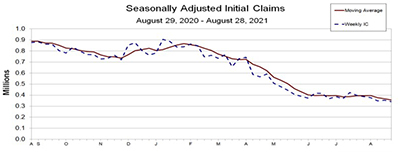

Initial claims for unemployment insurance resumed their trend downward following last week’s unexpected burp, the Labor Department reported Thursday.

The report said for the week ending August 28, the advance figure for seasonally adjusted initial claims fell to 340,000, a decrease of 14,000 from the previous week’s revised level to its lowest level since March 14, 2020, when it was 256,000. The previous week’s level revised up by 1,000 from 353,000 to 354,000. The four-week moving average fell to 355,000, a decrease of 11,750 from the previous week’s revised average to its lowest level since March 14, 2020, when it was 225,500.

The advance seasonally adjusted insured unemployment rate fell to 2.0 percent for the week ending August 21, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending August 21 fell to 2,748,000, a decrease of 160,000 from the previous week to its lowest level since March 14, 2020, when it was 1,770,000. The previous week’s level revised up 46,000 from 2,862,000 to 2,908,000. The fourt-week moving average fell to 2,855,000, a decrease of 58,000 from the previous week’s revised average to its lowest level for this average since March 21, 2020, when it was 2,071,750. The previous week’s average revised up by 11,500 from 2,901,500 to 2,913,000.

The report said the advance number of actual initial claims under state programs, unadjusted, totaled 287,751 in the week ending August 28, a decrease of 11,040 (3.7 percent) from the previous week. The seasonal factors had expected an increase of 2,793 (0.9 percent) from the previous week. Labor reported 827,261 initial claims in the comparable week in 2020. In addition, for the week ending August 28, 44 states reported 102,405 initial claims for Pandemic Unemployment Assistance.

The advance unadjusted insured unemployment rate fell to 1.9 percent during the week ending August 21, a decrease of 0.2 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 2,617,062, a decrease of 192,687 (6.9 percent) from the preceding week. The seasonal factors had expected a decrease of 31,769 (1.1 percent) from the previous week. A year earlier the rate was 9.0 percent and the volume was 13,111,418.

The report said total continued weeks claimed for benefits in all programs for the week ending August 14 rose to 12,186,158, an increase of 178,526 from the previous week. Labor reported 29,747,649 weekly claims filed for benefits in all programs in the comparable week in 2020.

The initial claims report is the second of three key snapshots of employment this week. On Wednesday, ADP, Roseland, N.J., said private-sector employment increased by 374,000 jobs between July and August. This morning, the Bureau of Labor Statistics will issue its monthly Employment Situation report on August jobs.

Mike Fratantoni, Chief Economist with the Mortgage Bankers Association, will provide commentary and analysis in Tuesday’s MBA NewsLink (which will not publish Monday for the Labor Day holiday), along with Odeta Kushi, Deputy Chief Economist with First American Financial Corp.; Doug Duncan, Chief Economist with Fannie Mae; and Jay Bryson, Chief Economist with Wells Fargo Economics.