Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 3

As business and social media brim with excitement of concerts, dining out and conducting in-person meetings, a quiet catapulting of M&A activity is also taking place. Driven by varied economic and innovation demands, acquiring firms are seeking out takeover targets that will provide scale, in-demand products and services, and counter-cycle customer solutions, which smooth out balance sheets and limit risks. The tradition of M&A has been resurrected with global deals up over 60% from 2019. Will FSI leaders be ready for an estimated tripling of M&A events within their industry over the next 12 months?

For financial services and mortgage leaders, estimates for the next 18-24 months indicate that 50% of new revenue will be derived from an M&A event with 35% to 40% of industry leaders actively seeking acquisition targets. Focus is shifting to reducing traditional customer contact (e.g., branches) point of service in favor of digital offerings tightly coupled with cross-industry consumer touchpoints and trendy outside-industry products. To this point, another trend accelerates the removal of bankers from the financial equations (e.g., embedded financial services, EFS). Actively being adopted by hyper retailers like Amazon and Walmart, EFS is pushing bankers and lenders into second-tier customer contact relationships—resulting in accelerating deficiencies of data, householding, and cross-selling opportunities. How will FSI leaders respond to the financial supply chain transformations—increase M&A activity?

Additionally, regulators and the vocal politicians spurring them on, are seeking new and old anti-trust remedies now that the top 15 FSI firms control over 50% of all assets which is 300% greater than in 2008. The mantra appears to be transforming post-2008 from “too-big-to-fail” into “too-big-to-govern.” Still are these the correct data points for M&A FSI actions (e.g., leading to carve-outs, acquisitions, breakups) to implement growth-enabled operating models and rapid-cycle innovations increasingly measured in months—not years—of applicability?

Making M&A even more challenging is the teams, and especially the advisors, who speak a different language than those orchestrating the day-to-day organizational and customer solutions. M&A groups are driven by market and investor forces that appear tangential, that is focusing their priorities of the M&A event on a future state, which often is a material contributor why over 80% of M&A events fail to meet ROI, customer experiences, and synergy projections. As the consumer, housing, and economic shifts continue (not factoring in a failure to raise the U.S. debt ceilings), the financial markets are poised for extensive consolidation. However, the data they need to aggressively compete within a data defined future is becoming further out of their reach as bankers are pushed away from traditional contact points. What should be done?

The M&A Demands for FSI Leaders has Permanently Transformed

The previous M&A events within financial services and mortgage firms looked within the industry—not across the consumers and their choices. Already underway, there is a deal and integration phase-shift surrounding traditional prescriptive approaches versus innovative frameworks driven by growing galaxies of data, machine learning, and artificial intelligence solutions. The demands for experiential diversity within the M&A framework and the personnel needed for successful execution is why an estimated 45% to 55% of all M&A growth actions until 2025 will be driven by the securing of new, relevant data sources. It points to FSI looking consistently outside their industry for new opportunities.

Moreover, as Covid took the world by surprise and chaos these last 18 months, there have been numerous M&A trends impacting traditional business models, product offerings, and consumer behaviors:

- Small business profits are still down by over 30%,

- Global supply chains are broken and may not be corrected until 2023 (pushing inflation beyond the U.S. Federal Reserve targets),

- The number of Fintech providers will surpass 13,000 by the end of 2021 each with increased specialization and complexity of offerings,

- With EFS, Fintech providers now control nearly 10% of the financial markets directly bypassing bankers and lenders completely,

- Startups now consistently surpass 400,000 new firms per month since March 2020 (over double the historical number),

- Worker and skill set voids are shaving hundreds of billions from U.S. GDP with aging workers exiting the labor markets (multiplying the openings) leaving millions of skilled jobs unfilled,

- Governments once propping up markets with artificial rates have contributed to inflation and lower borrowing costs pushing equity markets and loans outstanding higher (globally over $20 trillion in new government debt directly attributable to Covid Stimuli) and counting, and

- Electorate polarization continues to grow with these segregated divisions becoming a part of economic positioning and business delivery resulting in cascading patterns of opportunistic innovations and unaddressed workers’ rights.

Additionally, against these trends and within the context of M&A markets, the next 18 months indicate that between private equity, independent investors, and investment bankers there it is estimated that well over $3 trillion in “dry capital” is waiting to be used for takeovers, buyouts, or SPACs/IPOs. The excitement surrounds the realities that between the economic shifts and healthcare crisis, “only the visionary will survive” creating opportunities that allow smaller firms to consume larger brands struggling to adopt the data dark matter and adapt advancements into customer-facing operational excellence. However, why will 65% to 80% of these M&A (and buyout) events fail in under 24 months?

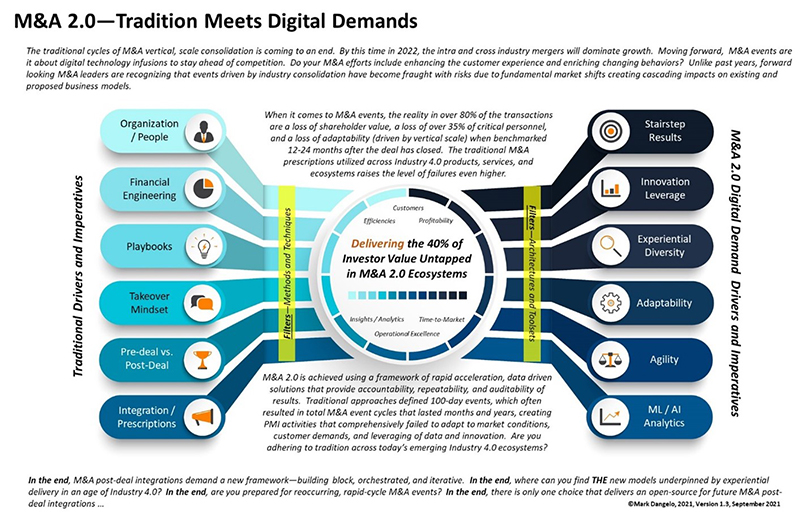

Just as consumers demands and behaviors are rapidly shifting, those leading M&A pursuits and events find themselves seeking out and demanding different strategies, success targets, and guaranteed outcomes. As we have explored in all three articles of this series, Industry 4.0 business demands have altered the who, what, where, why, and how of M&A strategy, due diligence, and PMI actions all as an implication of anticipating and acting upon vast quantities of data and innovation advancements. However, to be successful in these new M&A ecosystems, are leaders and their advisors asking the right questions (see figure below)?

M&A events, which were once driven by scale, vertical consolidations, and cost-efficiencies are being measured by consumers and investors against evolving Industry 4.0 economic measures, ESG (environment, social, governance) benefits, and innovation life cycles (including social responsibility and sustainability). Factor in changing payment options (e.g., CBDC, cashless systems including P2P, cybercurrencies), and the models that made investment bankers (IB) rich using fee-based services are all being challenged for their bottom-line contributions. Nowhere is this shift more pronounced than in the world of private equity (PE) where deals are increasingly being funed outside traditional, IB financing models (currently represents nearly $100 billion—a doubling from 2019-2020).

The Traditions are Failing Under New Drivers

Consumers have thousands of choices when it comes to finances. From startup, online only banks to cybercurrencies to rapidly forming sovereign central bank digital currencies (CBDC) to peer-to-peer payments (P2P), the ability to conduct financial transactions are being driven by advanced technologies and building block solutions, which are increasingly familiar to the Gen Y and Z customers—who distrust banks and bankers. These realities for M&A events point to a new framework—M&A 2.0 where tradition meets digital demands. Digital transformations now common across FSI and many industries now unleash unfamiliar synergy targets where up to 40% of the post-deal valuation is tied to enabling innovation compared to the M&A 1.0 takeover mindsets that dominated M&A playbooks. Below is a snapshot of how the two M&A worlds meet to enable cross-domain combinations.

Putting the above diagram into the context of identifying and conducting M&A from now until the end of 2025, what are the drivers (e.g., rationale) and solutions (e.g., implications) of M&A events for your organizational situation? Let ask a few more questions to showcase the shifts.

- As c-levels and board members look to improve operational flexibility and achieve scale using M&A events, what are the key differences they are anticipating with the meteoric rise of data within the enterprises and across their varied ecosystems of delivery? How will this impact due diligence? What are the “next” cycles or approaches when it comes to PMI (post-merger integration) needed to improve success?

- What are the top three drivers pushing forth M&A your events for the next 6 months? Will these change over the next 18 months (if so, what would they be and why different)? How does this impact your approach?

- What are the top five challenges facing your M&A event during the deal phase(s) over the next 24 months? Are these challenges the same in post-deal, or has the traditional, serialized processes driven by 100-day programs been transformed due to expanding digital demands and operational capabilities?

- What impact does innovation produce when it comes to M&A events? Are these prescriptive solutions or frameworks of activities? How will your M&A organizations leverage or containerize their combined innovation abilities during and after the event?

- What is the biggest surprise you are anticipating because of Covid and the rapid shifts in modes of operations, business models, workforce engagement, and/or customer expectations?

- How prepared are organizational leaders when it comes to Industry 4.0 and the innovation demands requires by regulations, customers, investors, or employees operating within their new engagement environments? How will you leverage the capabilities and culture within the M&A events to ensure that transference of capabilities is instilled within the combined enterprises (once your efforts have been completed)?

- As M&A traditional practices give way to digital demands, is it about technology, data governance and curation, COE teams (e.g., experiential diversity), or something else (or all the above)?

Challenging the beliefs that have guided traditional M&A practices for the last three decades is long overdue—the comprehensive shift to digital has just made it painfully obvious to anyone looking for greater post-deal success. For FSI and mortgage leaders, the rapid shift and acceptance M&A 2.0 will be difficult and challenging, as the solution sets themselves are emerging and amorphous.

WARNING—Under Construction

The model and questions above demonstrate that the old M&A methods and techniques have relevancy, but when faced with rapid-cycle iterations, they lack efficacy to achieve the synergy results and market expectations. The “old” matters, but its usage is different and non-prescriptive when confronted with M&A digital demands. The prior methods were about planning and dogmatic adherence to the schedule—one size fits all. Today, plans are important, but they must be integrated with D2I2 (define, develop, implement, iterate) to achieve the ability to cost-effectively pivot towards a digital demanded future state. Using adaptation and data leverage, the traditional processes will aid the M&A post-deal leaders practicing orchestration. M&A 2.0 is based on data and the adaptability that it delivers.

During M&A post-deal events when asking questions is considered a passive aggressive behavior, the challenging of commonplace strategies and answers are frequently labeled as subversion by dogmatic leaders (e.g., that employee has a “bad attitude”). However, the impacts to consumers, investors, and employees against the forced march of traditional approach often creates chaos and lost revenue because of the gap between what was expected, what is possible, and what was delivered.

For M&A FSI leaders, you cannot continue to execute integration paths during the rise of Industry 4.0 using the familiar remedies devised during Industry 3.0. The need to prepare to the future “Unknown Unknowns” starts with asking questions—a lot of them. The need to ask questions as we experience consequential business model and value proposition fractures is more important than prescriptive answers delivered by pundits, investment bankers, or now, private equity firms.

As we have proposed and explored, the M&A digital demands for post-deal events will not follow a traditional playbook set forth within M&A virtual data rooms (VDR) or post-deal merger implementation (PMI) checklists, software, and processes. M&A events will require adaptability to continually shifting business results and economic realities. They will follow the D2I2 adaptive approach. The old approaches are selectively valid but only for known knowns—not unknown unknowns.

Projections now estimate that another 1,000 banking brands may be lost to M&A events in under 48 months. If we factor in rising non-traditional digital competitors who bypass banking intermediaries (and their limited product and service value proposition), the loss may be as high as 1,500 during the same period. During an M&A event, the cascading challenges to leverage these siloed data innovations across Industry 4.0 ecosystems requires a framework that moves beyond the prescriptive, one-size-fits-all strategy applied to asynchronous integration programs.

In the end, M&A digital demands have changed the entire event. In the end, the real question will be how FSI leaders will react to competing in an ecosystem of solutions where they cannot dictate the terms and conditions. In the end, FSI leaders must accept that the embrace of digital has brought with it new, unfamiliar M&A constraints, capabilities, and opportunities, while forcing acceptance of implications, which digital adoption has created when applied to complex, serial M&A events. In the end, M&A 2.0 has already arrived with its unknown unknowns—will bankers and organizations be part of the solutions, part of the problems, or leading the way forward?

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)