MBA Chart of the Week Oct. 4, 2021

Source: MBA Research Institute for Housing America (RIHA).

Last week, the Research Institute for Housing America, MBA’s think tank, released a special report, The Impact of Climate Change on Housing and Housing Finance.

The report, authored by Sean Becketti, reviews what we know so far about climate change; the likely impacts to housing and housing finance; strategies that can mitigate climate change or adapt to the part of climate change that cannot be averted; and what housing and housing finance firms can do to articulate and measure their exposure to climate change.

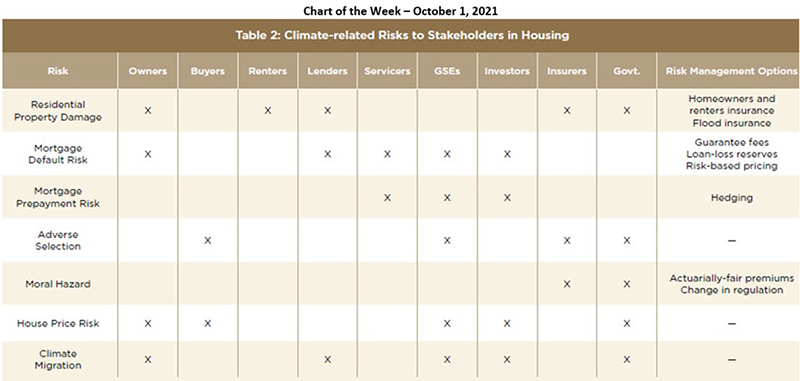

This week’s MBA Chart of the Week replicates table 2 from the report. This table lists risks that will likely increase or change because of climate change along with an indication of impacted stakeholders. For example, under the notion that climate change related natural disasters will lead to increases in mortgage default, Becketti gauges that owners, lenders, servicers, the GSEs and investors will be the stakeholders most directly impacted.

The table also provides some approaches stakeholders may employ to manage the risks (in the last column). These approaches are not an exhaustive list of options stakeholders can deploy, and the report emphasizes that despite the increasing pressure on firms to quantify climate-related risks and to articulate risk management plans, there remain three primary obstacles:

First, the Intergovernmental Panel on Climate Change considers temperature change and sea level rise projections for four scenarios. Moreover, these projections depend on a host of actions that can be taken by governments, firms, and individuals – giving a wide range of possible climate futures. This leaves a bewildering choice of paths risk managers could use (as opposed to the prescribed CCAR and DFAST paths used in stress tests).

Second, there is a lack of a generally-accepted indicator of the likelihood of extreme weather events. That is, the best practice for modeling has yet to be defined.

And third, there is a lack of historical values of climate risk indicators, leading to the need of judgment by modelers to incorporate them into their models. As we witnessed in the financial crisis of 2007-08, many modelers’ judgments turned out to be widely inaccurate and risk managers learned to be patient and accumulate observations to reach consensus. This remains a work-in-progress.

Becketti’s RIHA report provides an important assessment for the mortgage industry to better address the growing impacts of climate change and prepare for increased reporting to regulators and investors on the quantitative estimates of climate-related risks.

–Edward Seiler eseiler@mba.org.