J.D. Power: Record Origination Volume Causes Customer Satisfaction to Erode

There are two main takeaways from the J.D. Power 2021 U.S. Primary Mortgage Origination Satisfaction Study: first, there can be too much of a good thing; and second, Rocket Mortgage/Quicken Loans didn’t top the customer satisfaction list for the first time in 11 years.

The study said record 2020 mortgage originations—nearly $4.4 billion by its estimates—and higher profits, along with a perfect storm of low interest rates and high home values kept the “gold rush” going in 2021. However, the study also found mortgage originators have struggled to manage surging refinancing volume and efforts to streamline new issuance with one-size-fits-all digital workflows have eroded customer satisfaction at critical points along the way.

“Mortgage originators have been working for years to create an effective and efficient origination process, primarily through digitization of the process and implementation of self-help tools, but the massive surge in volume has exposed some serious weaknesses in that approach,” said Jim Houston, managing director of consumer lending and automotive finance intelligence with J.D. Power, Westlake Village, Calif. “It’s not enough to provide consumers with electronic applications and digitized tools to streamline and expedite activities up to and including loan closing. Today’s mortgage customers expect personalized, highly customizable experiences that include the right mix of technology and personal interactions based on their unique needs and wants.”

Key findings of the 2021 study:

- Overall customer satisfaction falls across most segments: Overall customer satisfaction with primary mortgage originators dropped five points (on a 1,000-point scale) this year, driven largely by declines in satisfaction with the refinancing process. Both banks and non-banks have seen declines in scores in all factors.

- Digital self-service combined with live personal service key to retention of younger customers: More than three-fourths (76%) of Generation Y and Z mortgage customers who use both live personal service and digital self-service channels during the application and approval process say they “definitely will” consider their lender for their next refinance. That rate falls more than 10 percentage points when only one of these two channels is used.

- Application and approval experience still requires some level of human interaction: Among Gen Y and Z mortgage customers, the perceived timeline from application start to approval is shortest when live personal service and digital self-service are combined (12.7 days on average). When traditional/text communication methods (e.g., e-mail, mail, text) are added to the mix, the perceived timeline increases to an average of 21.5 days.

- Omnichannel optimization needed: Nearly one-third (29%) of mortgage customers indicate using all three interaction channels—live personal service, digital self-service and traditional (mail or email) or texting—during their loan origination. This results in lower satisfaction and perception of lengthier timelines than when the optimal combinations of interaction are used. The industry challenge is not to go all digital or all live personal service, but to tailor the right communication to the right customer at the right time.

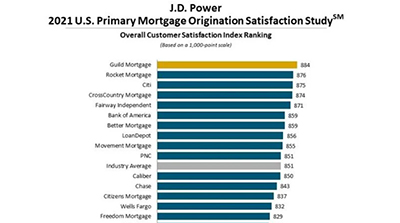

The report said Guild Mortgage ranked highest in mortgage origination satisfaction, with a score of 884. Guild scored highest in all four categories, Application and Approval, Loan Offering, Loan Closing and Communication. Rocket Mortgage (876) ranked second, falling from the top spot for the first time since 2010. Citi (875) ranked third.

The study measures overall customer satisfaction based on performance in four factors (in alphabetical order): application/approval process; communication; loan closing; and loan offering. The study was fielded in June-September and is based on responses from 5,414 customers who originated a new mortgage or refinanced within the past 12 months.