Industry news from Optimal Blue, Guild Mortgage, eHome America, Click n’ Close, NotaryCam, CampusDoor, LoanSense, RanLife and Dark Matter Technologies.

Tag: Guild Mortgage

People in the News, Oct. 23, 2024

Industry personnel news from Guild Mortgage, Fairway Independent Mortgage Corp. and Westcor Land Title Insurance Co.

People in the News, Oct. 22, 2024

Industry personnel news from Guild Mortgage, Fairway Independent Mortgage Corp. and Westcor Land Title Insurance Co.

Industry Briefs, Aug. 12, 2024

Industry news from a360inc, ProVest, CoreLogic, ACES Quality Management, Voxtur, Deephaven, Platte River Mortgage, Calque and Guild Mortgage.

Industry Briefs Sept. 5, 2023

Industry briefs from Guild Mortgage, Capacity and KSL Capital Partners.

Industry Briefs Sept. 1, 2023

Industry briefs from Guild Mortgage, Capacity and KSL Capital Partners.

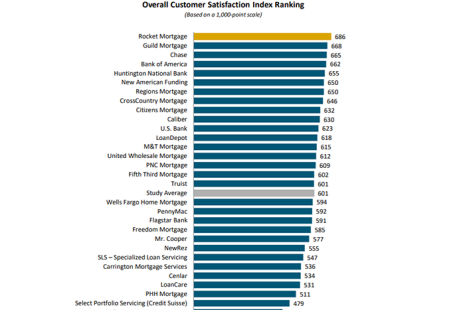

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.

Industry Briefs Mar. 24, 2023: Black Knight Says Prepayments Rebound from Record Low

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate increased by 7 basis points in February to 3.45%, but fell by 12.6% year over year. Meanwhile, prepayment activity inched up to 0.35%, breaking a four-month streak of record lows.

Industry Briefs Mar. 17, 2023: HUD Overhauls Disaster Recovery Program

HUD announced an overhaul of the agency’s disaster recovery efforts to better serve communities that face the direct impacts of weather-related disasters.

Industry Briefs Feb. 13, 2023: Guild Mortgage Acquires Legacy Mortgage

Guild Mortgage, San Diego, increased its Southwest presence with acquisition of Legacy Mortgage, an independent New Mexico-based lender.