MBA Advocacy Update Nov. 15 2021

On Wednesday, the Consumer Financial Protection Bureau issued a statement in conjunction with other federal and state financial regulators that announced the end of Regulation X mortgage servicing flexibilities that have been in place since April 2020 as a result of the COVID-19 pandemic.

Investors Increase Commercial Real Estate Allocations

Despite decreased returns in 2020, institutional investor confidence in commercial real estate remains strong, according to Hodes Weill & Assocs. and Cornell University’s Baker Program in Real Estate.

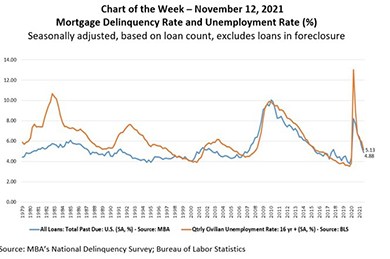

MBA Chart of the Week Nov. 12, 2021: Mortgage Delinquency Rate & Unemployment Rate

The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter, according to the Mortgage Bankers Association’s National Delinquency Survey, released last week.

MBA CONVERGENCE Partner Profile: Stephanie Moulton

The Ohio State University is a key leader in CONVERGENCE Columbus; Dr. Stephanie Moulton is the co-lead of the Evaluation Framework Working Group for CONVERGENCE Columbus.

MBA: Mortgage Delinquencies Decline for 5th Straight Quarter

Mortgage delinquencies fell for the fifth straight quarter to well under 5 percent, the Mortgage Bankers Association reported Wednesday.

Industry Briefs Nov. 12, 2021: Ginnie Mae October MBS Issuance Tops $69B

Ginnie Mae, Washington, D.C. reported mortgage-backed securities issuance volume for October rose to $69.36 billion. It said 253,996 homes and apartment units were financed by Ginnie Mae guaranteed MBS.