MBA: Mortgage Delinquencies Decline for 5th Straight Quarter

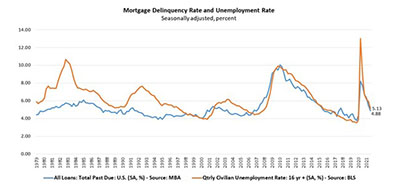

Mortgage delinquencies fell for the fifth straight quarter to well under 5 percent, the Mortgage Bankers Association reported Wednesday.

The MBA quarterly National Delinquency Survey reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate fell by 59 basis points from the second quarter and by 277 basis points from one year ago.

“For the fifth consecutive quarter, the mortgage delinquency rate declined, commensurate with a decline in the U.S. unemployment rate over the same time period,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “The improvement was driven entirely by a decline in later-stage delinquent loans – those loans that are 90 days or past due, but not in foreclosure. By the end of the third quarter, many borrowers were approaching the 18-month expiration point of their forbearance terms and were being placed in permanent home retention solutions, such as modifications and loan deferrals.”

Walsh noted these borrowers entered permanent post-forbearance workouts and resumed payments, they moved from delinquent to current status. She also said while the impact of the COVID-19 pandemic is waning, there are regional differences and other reasons for homeowner distress. For example, the mortgage delinquency rate in Louisiana increased by 118 basis points in the third quarter from the damage and displacement caused by Hurricane Ida’s August landfall. Furthermore, a 3 basis-point increase in the delinquency rate was reported in Wyoming because of wildfires. These factors may have played a role in the slight uptick in earlier-stage delinquencies at the national level.

“The effects so far have been muted from the July 31 end date of the foreclosure moratorium on federally-backed loans,” Walsh said. “The foreclosure starts rate matched an all-time survey low first reached in 2020, and the foreclosure inventory rate dropped again. Homeowners, investors and servicers have better options than proceeding with a costly and time-consuming foreclosure process.”

Other key findings of the MBA Third Quarter of 2021 National Delinquency Survey:

–From the second quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased by 10 basis points to 1.51 percent; the 60-day delinquency rate remained unchanged at 0.52 percent; and the 90-day delinquency bucket decreased 68 basis points to 2.85 percent.

–By loan type, the total delinquency rate for conventional loans decreased 34 basis points to 3.55 percent over the previous quarter. The FHA delinquency rate decreased 143 basis points to 11.34 percent and the VA delinquency rate decreased by 66 basis points to 5.81 percent. For each of these three loan types, the delinquency rate reached the lowest level since first quarter 2020.

–On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 238 basis points for conventional loans, by 425 basis points for FHA loans and by 235 basis points for VA loans.

–The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter fell to 0.46 percent, down by 5 basis points from the second quarter and by 13 basis points from one year ago. This is the lowest foreclosure inventory rate since fourth quarter 1981. The percentage of loans on which foreclosure actions started in the third quarter fell by 1 basis point to 0.03 percent, the lowest starts rate reported in the survey and consistent with the last three quarters of 2020.

–The non-seasonally adjusted seriously delinquent rate (the percentage of loans that are 90 days or more past due or in the process of foreclosure) fell to 3.40 percent. It decreased by 63 basis points from the second quarter and decreased by 176 basis points from a year ago. The seriously delinquent rate decreased by 49 basis points for conventional loans, by 129 basis points for FHA loans and by 54 basis points for VA loans. From a year ago, the seriously delinquent rate decreased by 156 basis points for conventional loans, by 257 basis points for FHA loans and by 129 basis points for VA loans.

–States with the largest quarterly decreases in their overall delinquency rate were Nevada (98 basis points), Hawaii (83 basis points), New Jersey (74 basis points), Maryland (72 basis points) and Connecticut (71 basis points).

–States with either quarterly increases or the smallest quarterly decreases in their overall delinquency rate were Louisiana (118 basis points increase), Wyoming (3 basis points increase), Iowa (5 basis points decrease), Montana (10 basis points decrease) and West Virginia (14 basis points decrease).

Note: An estimated 1 million homeowners were on forbearance plans as of October 31. As previously stated, for the purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

The NDS covers 39 million loans on one- to four- unit residential properties. Loans surveyed were reported by more than 100 servicers, including independent mortgage companies and depositories such as large banks, community banks and credit unions.