BREAKING NEWS

Mortgage Applications Down in MBA Weekly Survey

Mortgage applications fell overall from one week earlier as interest rates inched up, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 30.

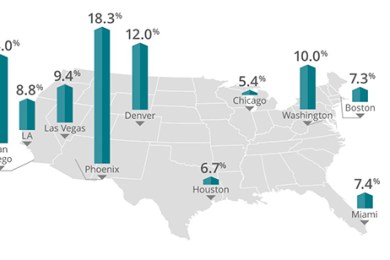

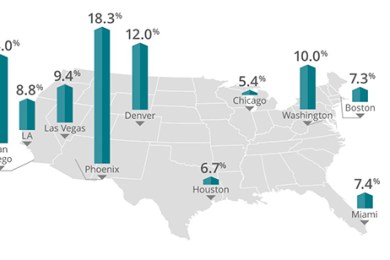

CoreLogic, Irvine, Calif., reported its monthly Home Price index recorded an 11.3% annual gain in March, the highest rate since March 2006.

The Consumer Financial Protection Bureau released two reports, saying more work needs to be done to help mortgage borrowers coping with the COVID-19 pandemic and economic downturn.

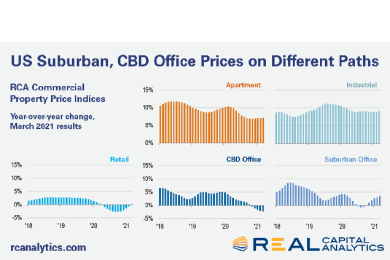

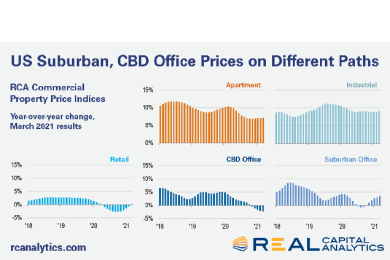

CoStar, Washington, D.C., reported commercial real estate asset prices diverged by property type during the first quarter.

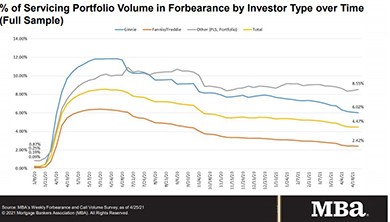

The private-label CMBS market remains a mixed bag showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

Protiviti is a global consulting firm that delivers deep expertise, objective insights, a tailored approach and unparalleled collaboration to help leaders confidently face the future.

Berkadia closed two multifamily transactions totaling $90.4 million in Virginia and Massachusetts.

Soaring home prices and raging demand will not be enough to slow the housing train. In fact, they may actually help it.

Tai Christensen is the Diversity, Equity and Inclusion Officer and the Director of Government Affairs for CBC Mortgage Agency, a national down payment assistance provider, and has 17 years of experience in the mortgage industry.

It is imperative for technology providers to help navigate the way through the process that could, if not addressed, destabilize the housing industry.

A recent McKinsey survey of 800 corporate executives found that after the pandemic, nearly 40% expect their employees in remote services to continue working two or more days a week away from the office. Surely, there are many companies in our industry who are planning to do the same. We’re not one of them and because of that, the pandemic was a big challenge for us.

In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.

The Mortgage Bankers Association’s Lisa J. Haynes and Charmaine Brown were recently recognized as leaders in diversity, equity and inclusion at the National Diversity Council’s four-day, virtual National Diversity & Leadership Conference, held this month.