MBA Chart of the Week, May 7, 2021: Renters/Mortgagors & Missed Payments

The Research Institute for Housing America, MBA’s think tank, released updated first-quarter results that allow us to assess how renters, mortgagors and student loan borrowers fared over the first 12 months of the COVID-19 pandemic.

The updated analysis of the Understanding America Study (UAS) panel survey data, conducted by Gary Engelhardt of Syracuse University and Mike Eriksen of the University of Cincinnati, provides close to real-time economic data on the evolving financial consequences of the pandemic by following, on a weekly basis, the same set of households from before the outbreak.

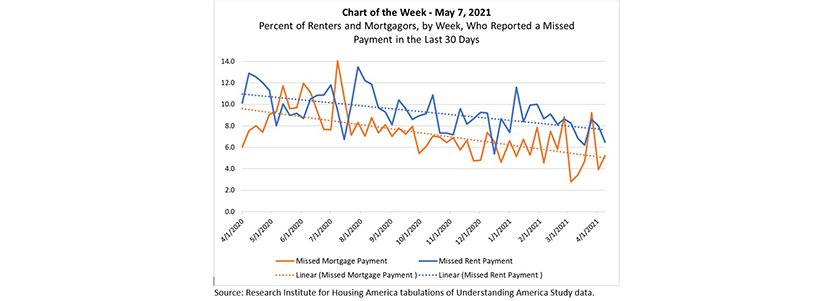

This MBA Chart of the Week plots the percentage of mortgagor and renter households who reported, on a weekly frequency, having missed a payment in the past 30 days.

Household financial distress persisted into the first quarter. While the percentage of missed payments has slowly declined, as depicted by the dashed linear trendlines in the chart, 7.7% of renters (2.56 million households) missed, delayed, or made a reduced payment in March, while 4.9% homeowners (2.33 million households) missed their mortgage payment. This is compared to a monthly average of 2.77 million renter households and 2.57 million mortgagor households in the fourth quarter.

The improving situation is also evident in other data. For example, according to MBA’s National Delinquency Survey, the seasonally adjusted delinquency rate decreased from 8.22% in second quarter 2020 to 6.73% in fourth quarter 2020, and again to 6.38% in first quarter 2021. However, this rate is still elevated compared to the 4.36% rate in first quarter 2020.

Engelhardt and Eriksen estimate that missed rental payments in the first three months of this year totaled $7.9 billion (vs. $7.4 billion in the previous quarter) and missed mortgage payments were $13.2 billion (vs. $14.5 billion). Over the past year, we assess that aggregate missed rental payments reached $35 billion, while missed mortgage payments reached almost $68 billion.

For additional highlights of the rich set of results, including insights on the financial distress among student loan borrowers, please see MBA’s press release.

–Edward Seiler eseiler@mba.org.