MBA: 1Q Mortgage Delinquencies Continue to Drop

The Mortgage Bankers Association on Friday reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 6.38 percent of all loans outstanding, seasonally adjusted, at the end of the first quarter.

The MBA 1st Quarter National Delinquency Survey said the delinquency rate fell by 35 basis points from the fourth quarter but rose by 202 basis points from a year ago.

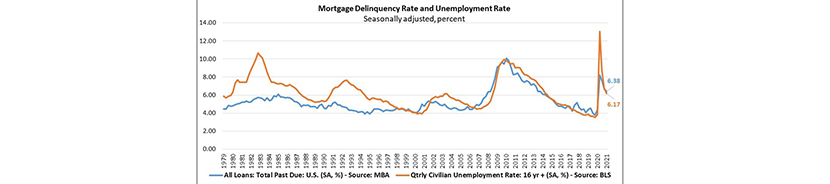

“A rebounding job market and stimulus checks helped borrowers stay current on their mortgage payments,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment dropping from last year’s spike, many households appear to be doing better.”

Walsh noted that in the history of the MBA National Delinquency Survey, there has never been such a substantial decline in the delinquency rate over such a short time. The mortgage delinquency rate peaked at 8.22 percent in second quarter 2020, and within three quarters has dropped by 184 basis points to 6.38 percent. In addition, this quarter’s earliest stage delinquencies – the 30-day and 60-day delinquencies combined – dropped to the lowest levels since the inception of the survey in 1979.

“Notwithstanding the welcome improvement in mortgage delinquencies and the positive job outlook, the delinquency rate this past quarter still remains 105 basis points higher than its historical quarterly average of 5.33 percent,” Walsh said. “We continue to see seriously delinquent loans – those loans that are over 90 days past due or in the process of foreclosure – at elevated levels, particularly for FHA and VA borrowers. With extended forbearance and foreclosure moratoria still in effect, many of these borrowers are reaching later stages of delinquency. Upon exiting long-term forbearance, some borrowers – regardless of their improving employment prospects – may need more complex workout options, such as loan modifications, to remain in their homes.”

Other key report findings:

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 32 basis points to 1.46 percent, the lowest rate since the survey began in 1979. The 60-day delinquency rate decreased 10 basis points to 0.67 percent, the lowest rate since second quarter 2000. The 90-day delinquency bucket increased 7 basis points to 4.25 percent.

- By loan type, the total delinquency rate for conventional loans decreased 52 basis points to 4.57 percent over the previous quarter. The FHA delinquency rate increased 2 basis points to 14.67 percent, while the VA delinquency rate increased by 33 basis points to 7.62 percent over the previous quarter.

- On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased by 141 basis points for conventional loans, by 498 basis points for FHA loans and by 297 basis points for VA loans.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions started in the first quarter rose by 1 basis point to 0.04 percent. The percentage of loans in the foreclosure process at the end of the first quarter fell to 0.54 percent, down 2 basis points from the fourth quarter and 19 basis points lower than one year ago. This was the lowest foreclosure inventory rate since first quarter 1982.

- The seriously delinquent rate–the percentage of loans that are 90 days or more past due or in the process of foreclosure–fell to 4.70 percent. It decreased by 33 basis points from the fourth quarter but increased by 303 basis points from a year ago. The seriously delinquent rate decreased by 34 basis points for conventional loans, decreased by 19 basis points for FHA loans and decreased by 37 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate increased by 205 basis points for conventional loans, by 771 basis points for FHA loans and by 379 basis points for VA loans.

- Note: An estimated 2.23 million homeowners were on forbearance plans as of April 25. For purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.