BREAKING NEWS

MBA Nominates Mark Jones of Amerifirst Home Mortgage as 2022 Vice Chairman; MBA Offices Closed Monday, May 31 for Memorial Day Holiday

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

Pending home sales took a step back in April, the National Association of Realtors reported on Thursday. All four U.S. regions recorded year-over-year increases, but only the Midwest saw month-over-month gains.

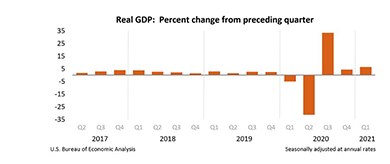

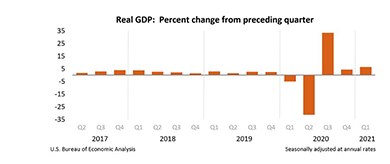

Second verse, same as the first: The Bureau of Economic Analysis on Thursday said its second (revised) estimate of 1st quarter gross domestic product showed economic growth increased at an annual rate of 6.4 percent, unchanged from its first estimate in April.

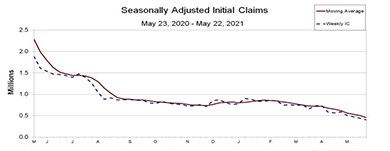

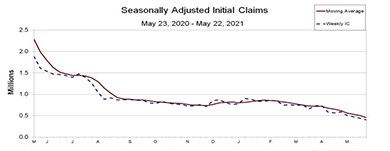

Initial claims for unemployment insurance fell for the fourth straight week to another 14-month low, continuing a trend toward pre-pandemic levels, the Labor Department said Thursday.

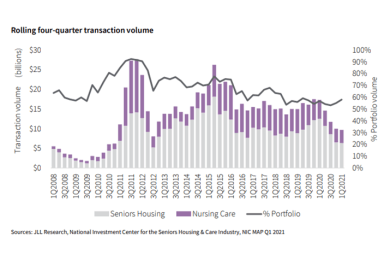

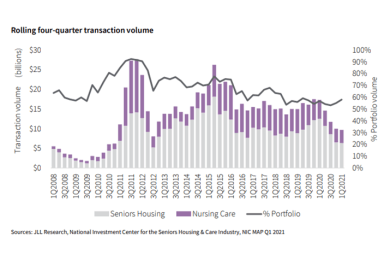

The seniors housing sector should grow as long-term demand remains positive and an aging Baby Boomer population needs more care, reported JLL Valuation Advisory, Chicago.

The largest risk in the real estate lending industry is the collateral securing the loan. Having thorough appraisal and evaluation programs in place is the best insurance to mitigate that risk. ServiceLink’s Laura Raposo explains how lenders can identify and select an AMC with an affirmed commitment to compliance, and the financial strength and stability to adhere to that commitment.

Stacey Berger, Executive Vice President and longtime Co-Head of Midland, Overland Park, Kan., recently announced his retirement effective May 31.

Institutional Property Advisors, Calabasas, Calif., closed two multifamily transactions totaling $110.9 million.

Enact Holdings Inc., Raleigh, N.C., a provider of private mortgage insurance through its insurance subsidiaries, introduced its new brand and visual identity. Formerly known as Genworth Mortgage Holdings Inc., Enact is a wholly owned operating subsidiary of Genworth Financial Inc.

Working from home proved liberating for many people, either because they got more work done or they gained a better work-life balance. At this point, we can’t just put the genie back in the bottle. So, how will the mortgage industry manage the shift back to the office, or will they? Now that our face-to-face meeting-driven, paper-intensive industry has been thrust into the future, does it make sense to return to the past?

When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008. Until 2020 the surveys were conducted face to face at the MBA National Secondary Market Conference every May and again in October at the MBA’s Annual Convention. However, the pandemic has shifted both sets of contacts to the telephone last year and this.

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.