2nd Look at 1Q GDP Unchanged at 6.4%

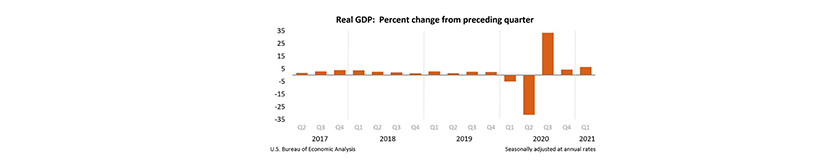

Second verse, same as the first: The Bureau of Economic Analysis on Thursday said its second (revised) estimate of 1st quarter gross domestic product showed economic growth increased at an annual rate of 6.4 percent, unchanged from its first estimate in April.

In the fourth quarter, real GDP increased 4.3 percent.

The revised GDP estimate is based on more complete source data than were available for the “advance” estimate issued last month. In the advance estimate, the increase in real GDP was also 6.4 percent. Upward revisions to consumer spending and nonresidential fixed investment were offset by downward revisions to exports and private inventory investment. Imports, which are a subtraction in the calculation of GDP, were revised up.

“The economy continues to climb out of the hole it fell into last year,” said Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C. “Real GDP plunged more than 10% between Q4-2019 and Q2-2020, the steepest downturn since the Great Depression. But three consecutive quarters of positive growth has left the level of GDP just 0.9% shy of its pre-pandemic peak. Most economic indicators suggest that real GDP will easily surge past its previous peak in the current quarter.”

BEA said the increase in first quarter GDP “reflected the continued economic recovery, reopening of establishments and continued government response related to the COVID-19 pandemic.” It noted in the first quarter, government assistance payments, such as direct economic impact payments, expanded unemployment benefits, and Paycheck Protection Program loans, were distributed to households and businesses through the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act.

The report said the increase in real GDP in the first quarter reflected increases in personal consumption expenditures, nonresidential fixed investment, federal government spending, residential fixed investment and state and local government spending, partly offset by decreases in private inventory investment and exports. Imports increased.

The increase in PCE reflected increases in durable goods (led by motor vehicles and parts), nondurable goods (led by food and beverages) and services (led by food services and accommodations). The increase in nonresidential fixed investment reflected increases in intellectual property products (led by software) and in equipment (led by information processing equipment). The increase in federal government spending primarily reflected an increase in payments made to banks for processing and administering the Paycheck Protection Program loan applications as well as purchases of COVID-19 vaccines for distribution to the public. The decrease in private inventory investment primarily reflected a decrease in retail trade inventories.

BEA also noted real gross domestic income increased 6.8 percent in the first quarter, compared to an increase of 19.4 percent (revised) in the fourth quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 6.6 percent in the first quarter, compared with an increase of 11.6 percent (revised) in the fourth quarter.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased by $0.2 billion in the first quarter, compared with a decrease of $31.4 billion in the fourth quarter. Profits of domestic financial corporations decreased $3.6 billion in the first quarter, compared to an increase of $17.5 billion in the fourth quarter. Profits of domestic nonfinancial corporations increased $12.4 billion, compared to a decrease of $48.2 billion. Rest-of-the-world profits decreased $9.0 billion, compared with a decrease of $0.7 billion. In the first quarter, receipts increased $31.0 billion, and payments increased $40.0 billion.