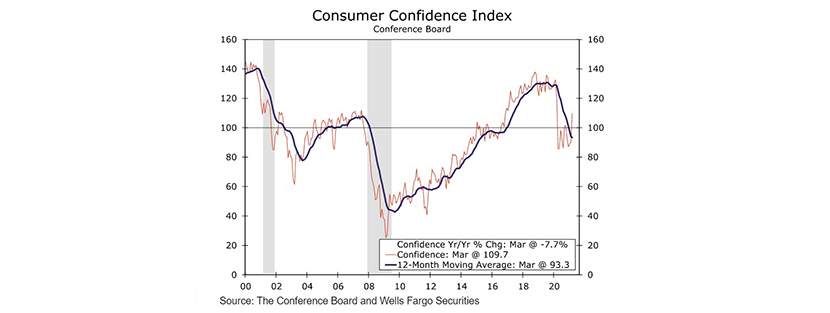

Consumer Confidence Hits Highest Level Since Pandemic

(Chart courtesy of Wells Fargo Securities, Charlotte, N.C.)

The Conference Board, New York, said its Consumer Confidence Index jumped by nearly 20 points in March to its highest reading in a year, after a modest increase in February.

The Index now stands at 109.7, up from 90.4 in February. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—climbed from 89.6 to 110.0. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—also improved, from 90.9 last month to 109.6 in March.

“Consumer Confidence increased to its highest level since the onset of the pandemic in March 2020,” said Lynn Franco, Senior Director of Economic Indicators with The Conference Board. “Consumers’ assessment of current conditions and their short-term outlook improved significantly, an indication that economic growth is likely to strengthen further in the coming months. Consumers’ renewed optimism boosted their purchasing intentions for homes, autos and several big-ticket items. However, concerns of inflation in the short-term rose, most likely due to rising prices at the pump, and may temper spending intentions in the months ahead.”

“Consumers certainly regained confidence in March,” said Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “The headline print of 109.7 handily exceeded even the most optimist forecast with room to spare. After a run of mostly disappointing February data, this surge is consistent with our expectation that we are at the start of a consumer spending spree.”

Quinlan noted in the wake of the latest stimulus bill, most private-sector forecasters and the Federal Reserve have dialed-up their expectations for growth. “That was a comfortable call to make after consumers started off the year with a January spending increase that was as strong as any month since the height of the re-opening spending spree last summer,” he said. “But, February saw sharp declines in personal outlays due in part to severe weather. If these bullish forecasts for the economy are going to be right, the consumer sector will have to rebound quickly.”

Quinlan added unlike other periods when consumers only felt enthusiastic about a wistful distant day when the pandemic might end, there was major improvement across all time horizons. “The fight against the virus may not be over, but good luck telling that to U.S. consumers flush with cash from the latest stimulus check,” he said.

The report said consumers’ assessment of current conditions improved significantly in March. The percentage of consumers claiming business conditions are “good” increased from 16.1 percent to 18.5 percent, while the proportion claiming business conditions are “bad” fell from 39.7 percent to 30.5 percent. Consumers’ assessment of the labor market also improved. The percentage of consumers saying jobs are “plentiful” increased from 21.6 percent to 26.3 percent, while those claiming jobs are “hard to get” declined from 22.4 percent to 18.5 percent.

Consumers’ optimism about the short-term outlook improved considerably. The percentage of consumers expecting business conditions will improve over the next six months rose from 30.7 percent to 40.8 percent, while the proportion expecting business conditions will worsen declined from 17.7 percent to 11.0 percent. Consumers’ outlook regarding the job market was also more favorable. The proportion expecting more jobs in the months ahead increased from 27.4 percent to 36.1 percent, while those anticipating fewer jobs declined from 21.3 percent to 13.4 percent. Regarding short-term income prospects, 15.5 percent of consumers expect their incomes to increase in the next six months, up modestly from 14.8 percent in February. However, 13.3 percent expect their incomes to decrease, up slightly from 12.9 percent last month.