BREAKING NEWS

MBA: Applications Down 3rd Straight Week in Weekly Survey

HUD released its quarterly report to Congress on the FHA Single-Family Mutual Mortgage Insurance Fund Programs. The report said the MMIF stands at more than $80 billion and remains well above the 2% minimum capital reserve required by Congress.

Despite a slight decrease in mortgage interest rates—the first such decline in nearly two months—mortgage applications fell for the third straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 26.

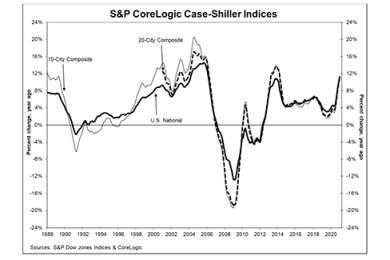

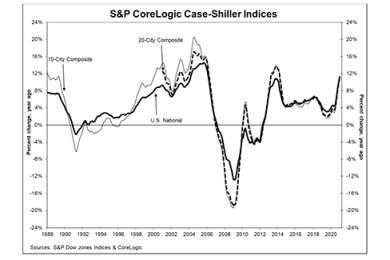

Home price appreciation continued its roar into the start of the year, with the Standard & Poor’s CoreLogic Case-Shiller Home Indices reporting double-digit percentage annual price growth in January.

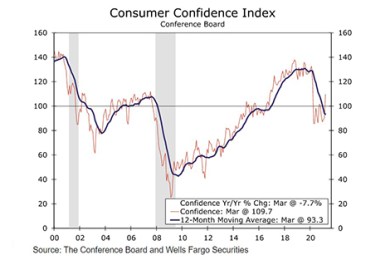

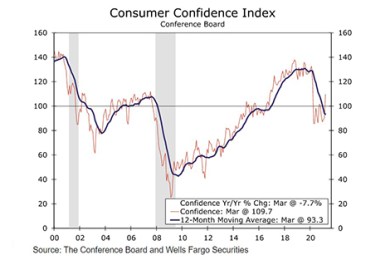

The Conference Board, New York, said its Consumer Confidence Index jumped by nearly 20 points in March to its highest reading in a year, after a modest increase in February.

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.

Marcus & Millichap arranged $116 million in financing for multifamily assets in Alabama, Colorado and New York.

The domino effect – an endless run of falling dominos winding through the residential home construction industry. That's a vision we can easily conjure up when witnessing the ongoing impacts of steadily rising construction costs. And guess who is at the end of the domino chain, having to deal with the residual mess? Residential home appraisers and their lender clients.

The Mortgage Bankers Association's young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Auction.com, Irvine, Calif., promoted Ali Haralson to president, a new position in the company that will oversee both sales and operations.

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

MISMO, the industry’s standards organization, developed iLAD through close collaboration across the industry, including with lenders, vendors, IT companies and GSEs. The MISMO Loan Application Data Exchange (LADE) Development Work Group is working to ensure these iLAD specifications will continue to evolve to meet industry needs.

While there is a tremendous benefit to adding Ginnie Mae specified (spec) pools as part of a diversified execution strategy, lenders cannot continue to operate as if it’s business as usual when faced with the current volatility in the mortgage-backed securities market. Instead, speed must become of the essence, and lenders need to move as quickly as possible while monitoring the MBS market closely to continue effectively utilizing this strategy and maximize their secondary profitability.

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.