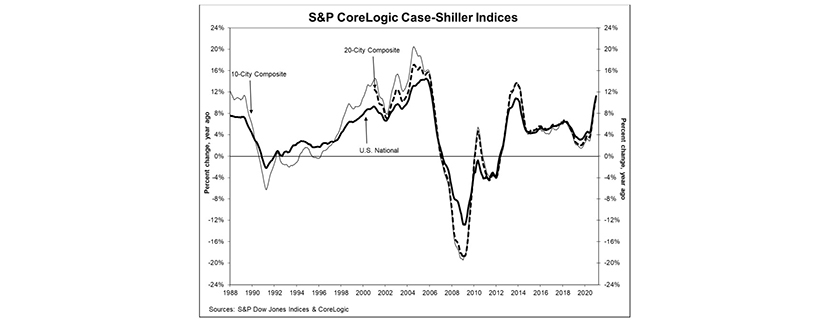

Double-Digit Home Price Gains to Start 2021

(Chart courtesy of Standard & Poor’s, New York.)

Home price appreciation continued its roar into the start of the year, with the Standard & Poor’s CoreLogic Case-Shiller Home Indices reporting double-digit percentage annual price growth in January.

The report said the U.S. National Home Price NSA Index reported an 11.2% annual gain in January, up from 10.4% in December. The 10-City Composite annual increase came in at 10.9%, up from 9.9% in December. The 20-City Composite posted an 11.1% year-over-year gain, up from 10.2% in December.

Phoenix led all cities with a 15.8% year-over-year price increase, followed by Seattle at 14.3% and San Diego at 14.2%. All 20 cities reported higher price increases in the year ending January from December.

Month over month, before seasonal adjustment, the U.S. National Index posted an 0.8% increase, while the 10-City and 20-City Composites posted increases of 0.8% and 0.9%, respectively, in January. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.2%, with the 10-City and 20-City Composites posting increases of 1.2% as well. In January, 19 of 20 cities reported increases before seasonal adjustment, and all 20 cities reported increases after seasonal adjustment.

“The strong price gains that we observed in the last half of 2020 continued into the first month of the new year,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P DJI. “The trend of accelerating prices that began in June 2020 has now reached its eighth month and is also reflected in the 10- and 20-City Composites.”

Lazzara said January’s performance is particularly impressive in historical context, noting the National Composite’s 11.2% gain is the highest recorded since February 2006. “In more than 30 years of S&P CoreLogic Case-Shiller data, January’s year-over-year change is comfortably in the top decile,” he said. “That strength is reflected across all 20 cities.”

Lazzara added January’s data remain consistent with the view that COVID has encouraged potential buyers to move from urban apartments to suburban homes. “This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years,” he said. “Alternatively, there may have been a secular change in preferences, leading to a shift in the demand curve for housing.”

“While double-digit home price growth has raised concerns about its sustainability, affordability crunch resulting from strong home price growth and higher mortgage rates will discourage some potential home buyers from entering the market and take some wind out of its sails, slowing the home price growth rate by about a half by the end of 2021,” said Selma Hepp, Deputy Chief Economist with CoreLogic, Irvine, Calif. “The biggest concern remains the lack of for-sale homes. Potential sellers may be discouraged by their inability to find a new home and subsequently choose to not list their own home – leading to a vicious cycle of declining for-sale homes.”

The report said as of January, average home prices for metros within the 10-City and 20-City Composites are exceeding their winter 2007 levels.