BREAKING NEWS

Rates--and Applications--Rise in MBA Weekly Survey

Mortgage interest rates jumped sharply last week, and mortgage applications increased as well, as some home buyers sensed the possible end of a good thing, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending February 26.

With federal foreclosure moratoria slated to end June 30, the Consumer Financial Protection Bureau this week issued a report warning of widespread evictions and foreclosures, absent additional public and private action.

In February, the commercial mortgage-backed securities delinquency rate saw its largest improvement since the pandemic started last year, reported Trepp, New York.

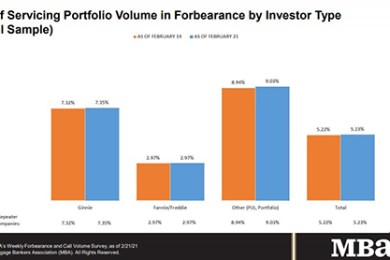

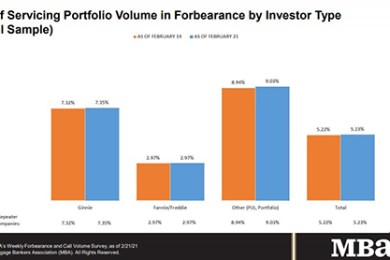

For the first time in five weeks, loans in forbearance increased, albeit ever so slightly, the Mortgage Bankers Association reported yesterday.

Gantry, San Francisco, secured $77.1 million in acquisition financing for two Arizona industrial properties.

Equifax, Atlanta, launched its Ignite Lost Sales Analysis platform, which leverages the Equifax cloud to provide the differentiated data, actionable insights and clear visualizations lenders need during prospecting, origination and portfolio retention.

Joe Murin is Chairman of JJAM Financial Services, Pittsburgh, Pa., which he founded in 2014. He previously served as Chairman of Chrysalis Holdings LLC and as CEO of ANC Holdings LP. Before that, he was Vice Chairman of The Collingwood Group and served as President of Ginnie Mae during the Obama Administration.

Consumers should be informed and aware that, even after the rate on their loan is locked and before it

closes, they have the option to move up and down the rate stack (as above) that was originally used to

lock their loan.

Daren Blomquist is vice president of market economics with Auction.com., Irvine, Calif. He analyzes and forecasts complex macro and microeconomic data trends within the marketplace and greater industry to provide value to both buyers and sellers using the Auction.com platform.

Spring EQ, Philadelphia, hired Saket Nigam as senior vice president of capital markets. He will be responsible for leading the company’s continued growth in the consumer-direct and wholesale mortgage markets for first and second mortgage products.

Snapdocs is a mortgage technology company that is hyper-focused on defragmenting the critical last mile in the loan origination lifecycle, the closing process.

The Mortgage Bankers Association announced members of its advisory councils for affordable rental housing and homeownership for 2021. The advisory councils were formed in 2019 to provide important strategic and practical guidance to MBA’s CONVERGENCE Initiative, the association’s affordable housing effort.