Ritesh Singhania: Mortgage Rate Buy-Down Points–to Sell or Not to Sell?

Ritesh Singhania is Founder of Loandrone Inc., Irvine, Calif., a consumer origination platform, that applies advanced analytics and artificial intelligence techniques to both acquisition marketing and fulfillment process with the objective of maximizing customer benefit from current interest rate environment. The company’s website is https://loandrone.com/.

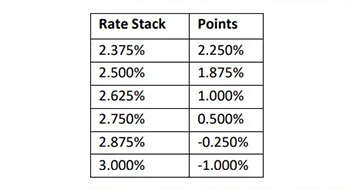

Lenders are often presented with the choice of selling some upfront points to buy down the fixed rate mortgage as against going for the zero-cost option, or even receiving points (to pay off closing cost) for selecting a higher fixed interest rate. These rate-point combinations are listed in a ‘rate stack’ and consumers can request the mortgage broker or lender for a screen shot of this table, specific to their loan level characteristics.

Example below is a Rate Stack of 30-year fixed-rate Conforming mortgages as on Feb 18, assuming a 700+ FICO, < 80% Loan To Value and <40% Debt to Income ratio.

Consumers should be informed and aware that, even after the rate on their loan is locked and before it

closes, they have the option to move up and down the rate stack (as above) that was originally used to

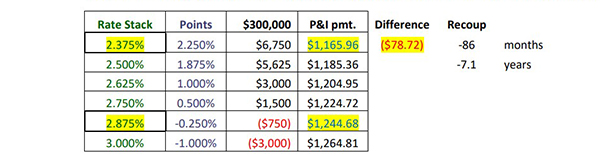

lock their loan. For example, assuming a loan amount of $300,000 and applying the rate stack as above,

the consumer has the option of locking in a rate of 2.375% for 30 years for a upfront cost of $6,750 ( this

can be added to the loan amount).

Alternatively, in the example above, the consumer can also select to lock the rate at 3.00% and receive $3,000 as a credit towards payment of closing costs associated with the loan. The question for lenders is: Is it better for the consumer to pay discount points and select the lower interest rate or select a higher rate that has non-costs or a credit associated with it?

FAST-THINKING Response

Conventional wisdom often suggests that it’s always better to go for the zero-cost option. The quick math to come to this conclusion is that if the consumer were to pay $6,750 in buy-down points to select the 2.375% as against the 2.875% rate that comes with a small credit, the recoup period for the additional cost of $6,750 will be nearly seven years (see calculations as below) in the example as above.

A couple of additional thoughts that solidify this thinking are: 1. Will the consumer sell their home or refinance again in 7 years? And 2. Will interest rates go down further during this 7 years. However, if the answer to this question was that obvious and affirmative, why would the lender offer the consumer to select among multiple rate point combinations? In fact, the lender is actually indifferent to the consumer’s choice as the rate stack is pricing in the probabilities of market expectations in rates and pre-payment of the loan.

SLOW-THINKING Response

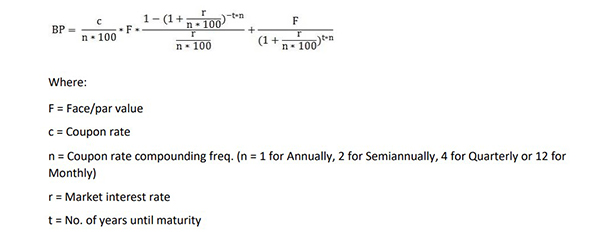

The more deliberated thinking response would be to first understand the bond math behind the rate stack. The generic formula for calculating the price of a bond (BP) is as below:

In the above equation, one of the biggest unknowns that Wall Street fixed-income analysts are trying to get right is the “t,” or number of year until maturity. A common variable used to determine this is the prepayment speed which is measured in terms of the CPR (Conditional Pre-payment Rate). The faster the pre-payment speed, the shorter the tenure of the loan, the lower the Bond Price (keeping all other things constant). To keep things simple and on topic, the point that is being made is that the Rate Stack in the example above assumes certain CPRs associated with each note rate in the stack.

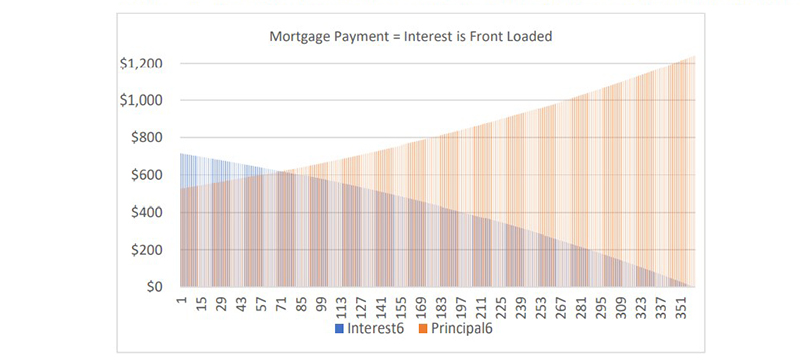

Another aspect to consider is that installment loans in general, including home loans, are structured in such a way that the interest cost is front loaded. This means that, with each fixed monthly Principal and Interest payment, the consumer is paying more towards the interest cost of the loan than building equity in their home during the initial years of the repayment period and this ratio reverses as the loan approaches maturity. In our example of the $300,000 loan amount for 30 years with a 2.875% rate, a visual of the monthly payments divided into interest payment and principal repayment looks like this:

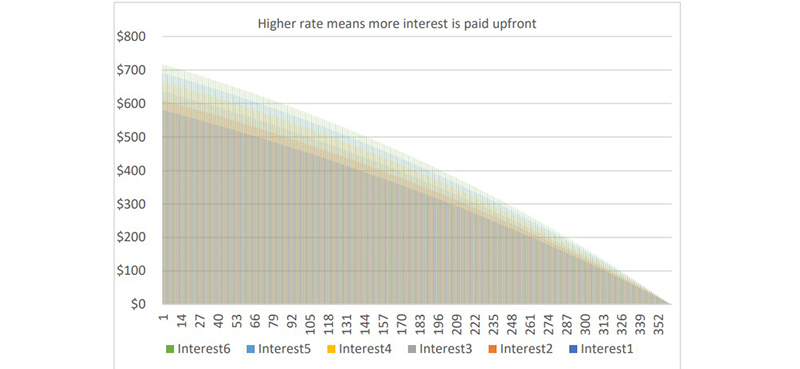

What this also means for our comparisons is that selecting a higher rate (with zero cost or a credit) means that the consumer is paying relatively more interest costs in the first few years of the loan as compared to the lower rate. This is visually captured in the chart as below that shows 30-year monthly payments towards interest for the six different rate choices from our rate stack; interest6 is the highest rate and interest1 is the lowest rate.

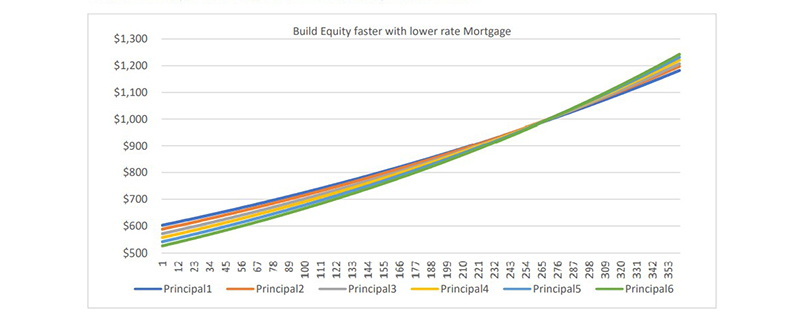

One may ask that, what about the higher initial loan amount for the lower rate (as the cost of the low rate is rolled into the loan amount) – how do we factor that into our analysis? It’s quite obvious, that the outstanding principal is higher for the lower rate choices, however, since the rate is lower the consumer building equity at a faster pace with the lower rate choice as compared with the higher rate choice. A visual of this aspect over the life of the loan is depicted as below:

In the chart above, and on a ‘apple-to-apple’ basis we can see that blue line (Principal1 associated with the lowest rate from our rate stack) is collecting more into ‘home equity’ as compared to the principal repayment plans for the higher rates.

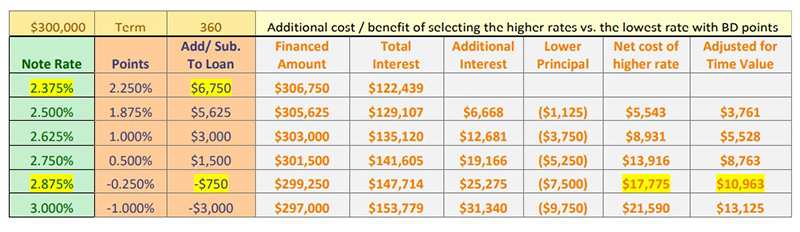

In fact, when we consider the total finance charge or the interest cost over the life of the loan, interestingly, the higher interest rate loan (the lowest loan amount) in our rate stack, has the highest amount of interest paid over the life of the loan. So the initial credit for the higher rate does not offset the higher interest cost for the life of the loan as can be seen below. On a nominal basis, the 2.875% note rate costs $17,775 more than the 2.375% over the life of the loan. After adjusting for the time value of money (assuming a discount rate of 3%), this 17,775 drops to $10,963 but is still a more expensive choice. Also to be noted is that since the interest is front loaded, most of this cost differential is realized upfront. Kind of explains why lenders are indifferent to the consumers choice of note rate in the rate stack.

So What Does All of this Mean For the Lender and Consumer?

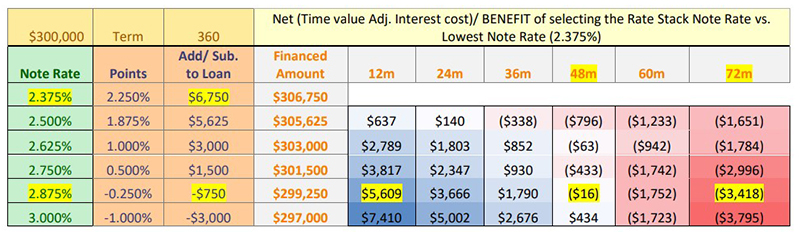

Breaking out the cost-benefits of each rate-point combination from the more deliberated thinking as above, results in the following table that captures the annual costs of selected interest rates and also the impact of the lower loan amounts associated with the higher rates in our rate stack. In the table below, the base case is assumed to be the lowest rate-point combination of 2.375% (costing 6,750).

So, after 12 months (12m), the consumer is better off by $5,609 by selecting the 2.875% note rate (that pays back a credit of $750) because of the significant savings from the lower loan amount to start. However, since this is a 30-year mortgage, as time progresses, these initial loan amount savings are quickly offset by the higher upfront interest payments and by the 48th month, the gains are negated and the loan starts becoming more expensive choice as compared to the 2.375% interest rate mortgage. By the 72nd month, the consumer is out of pocket by $3,418 from having selected the zero cost option.

Hence, our FAST-THINKING approach may not be fully capturing the aspect of interest costs of the loan being front loaded, which brings down the recoup period to about 48 months from 86 months assumed earlier.

Conclusion

Keeping this FAST- and SLOW–THINKING approaches in mind, we must understand that the rate stack is based on a certain assumption in pre-payment speeds of the rate-points combination. If consumers expect to sell their financed home or refinance faster than the pre-payment speeds assumed in the rate stack, it is better to select the higher rate (with credit). However, if the consumer plans to hang on to the mortgage rate for a longer time than the assumed pre-payment, we should opt for the lower rates (and pay discount points). This analysis and decision becomes all the more relevant in current interest rate environment, where it seems that we are coming off rock bottom rates that were artificially created because of the Fed’s unprecedented response to COVID-19.

Will we see these mortgage rates again in the next 4-6 years? What are your thoughts? The consumer’s view could cost or save thousands of dollars in interest costs on their mortgage. Your view could create a case for your sales team selling more Buy-Down Points and gaining market share in a rising rate environment.

(Disclaimer: The views and opinions expressed in this article are solely those of the author. Examples of

analysis performed within this article are only examples. They should not be used in real-world

analytic products as they are based only on very limited and dated open source information.)

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)