BREAKING NEWS

Mortgage Applications Down Again as Rates Hit 9-Month High in MBA Weekly Survey

Commercial/multifamily mortgage debt outstanding at the end of 2020 rose by $212 billion (5.8 percent) from the previous year, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report said.

Mortgage interest rates continued their slow but steady rise—reaching a nine-month high—putting a damper on refinance applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 12.

Despite high buyer traffic and strong demand, builder sentiment fell in March as rising lumber and other material prices pushed builder confidence lower, the National Association of Home Builders reported yesterday.

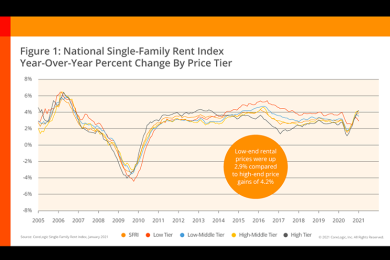

CoreLogic, Irvine, Calif., said single-family rent growth reached 3.8 percent year-over-year in January, up from a 2.9 percent annual increase a year ago.

![]()

U.S. consumers continue to be negatively impacted one year since the onset of COVID-19, although TransUnion, Chicago, reported positive signs in its latest Consumer Pulse study.

See How eCBSV is faster, cheaper, less error-prone and requires less manual work.

A Blackstone Real Estate Partners-Starwood Capital Group venture agreed to acquire Extended Stay America and its real estate investment trust ESH Hospitality for $19.50 per paired share in an all-cash transaction valued at nearly $6 billion.

Today’s customers live online and expect relevant, personalized content and messaging that resonates with their individual wants and needs. That leaves plenty of opportunity for lenders to connect with this massive cohort by providing value and education.

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.

ClosingCorp, San Diego, appointed Christine (“Chris”) Boring as chief product officer, responsible for defining and executing the company’s product vision and strategy and leading product development and implementation efforts.

Are we looking at a downturn? Yes, but in my view, it’s not going to be significant enough to see a huge migration of people out of the mortgage industry. It will, however, require every organization to think hard about how to best use their personnel resources to come out ahead.

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.