February New Home Applications Down 9% from January; Up 9.2% from Year Ago

The Mortgage Bankers Association Builder Applications Survey data for February show mortgage applications for new home purchases increased 9.2 percent from a year ago, but fell by 9 percent from January, unadjusted for typical seasonal patterns.

By product type, conventional loans composed 74.0 percent of loan applications, FHA loans composed 15.4 percent, RHS/USDA loans composed 1.5 percent and VA loans composed 9 percent. The average loan size of new homes increased from $363,493 in January to $370,679 in February, a record high.

“The economy and job market continue to improve, but new home sales activity slowed in February. Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Applications for new home purchase mortgages decreased last month but remained over 9 percent higher than a year ago, and MBA’s estimate of new home sales, at 748,000 units, was at its slowest annual pace since May 2020. After seven consecutive months of a strong 800,000-unit sales pace, supply and demand imbalances are likely creating bottlenecks.”

Kan added the average loan size measured rose to a record high of more than$370,000, and the conventional share of applications also hit a new high, “as overall housing inventory levels remain extremely low and are pushing home prices higher.”

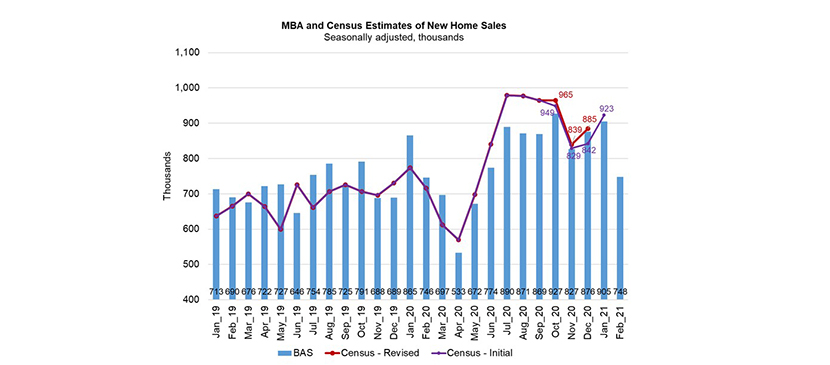

MBA estimated new single-family home sales at a seasonally adjusted annual rate of 748,000 units in February, based on data from the BAS, a decrease of 17.3 percent from the January pace of 905,000 units. On an unadjusted basis, MBA estimated 65,000 new home sales in February , a decrease of 5.8 percent from 69,000 new home sales in January.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The MBA Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using these data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state and metro level. These data also provide information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information about the MBA Builder Applications Survey, click here.