BREAKING NEWS

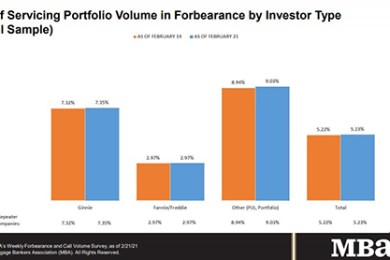

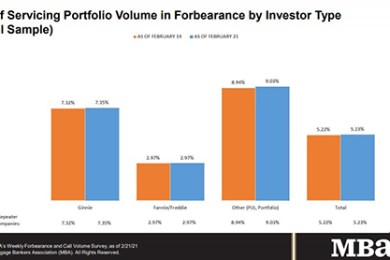

MBA: Share of Loans in Forbearance Up Slightly to 5.23%

For the first time in five weeks, loans in forbearance increased, albeit ever so slightly, the Mortgage Bankers Association reported yesterday.

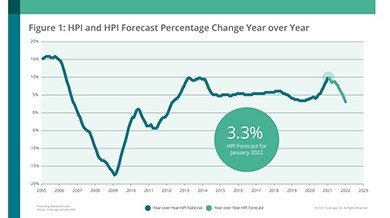

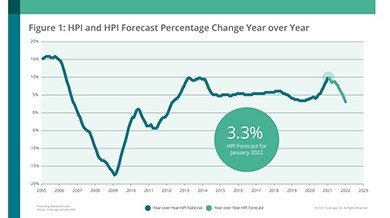

Add the CoreLogic Home Price Index to the growing Double-Digit Price Growth Club. The company’s monthly index showed nationally, home prices increased by 10 percent annually in January.

The Mortgage Bankers Association’s Capital Council hosted a panel on Thursday. Amidst an active policy landscape, commercial real estate advocates representing broad member constituencies discussed priorities for the new Congress and the Biden Administration.

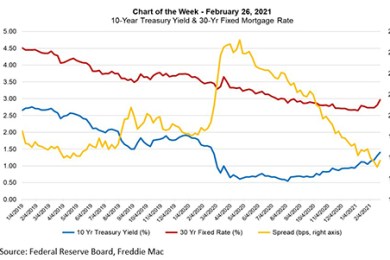

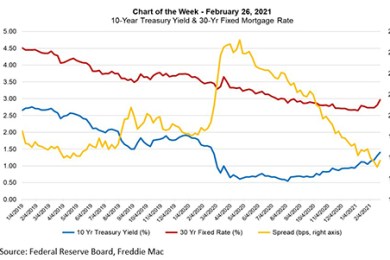

This week’s chart shows the recent climb in rates, and the spread between the 30-year mortgage rate, as surveyed by Freddie Mac, and the 10-year Treasury yield. As the 10-year has risen, so has the 30-year fixed rate, which has gone up 24 basis points since the beginning of February.

The Mortgage Bankers Association announced members of its advisory councils for affordable rental housing and homeownership for 2021. The advisory councils were formed in 2019 to provide important strategic and practical guidance to MBA’s CONVERGENCE Initiative, the association’s affordable housing effort.

U.S. commercial property prices grew again in January, sector analysts reported.

NorthMarq, Minneapolis, arranged $55.2 million for industrial and multifamily assets in Ohio and Washington.

Consumers should be informed and aware that, even after the rate on their loan is locked and before it

closes, they have the option to move up and down the rate stack (as above) that was originally used to

lock their loan.

Daren Blomquist is vice president of market economics with Auction.com., Irvine, Calif. He analyzes and forecasts complex macro and microeconomic data trends within the marketplace and greater industry to provide value to both buyers and sellers using the Auction.com platform.

At some point in the future, however, it’s inevitable that the market will shift—and it’s not too soon to prepare. And just as outsourcing has helped many originators overcome unprecedented capacity issues while volumes are high, it may again prove to be the best strategy for organizations transitioning to the next market environment.

Snapdocs is a mortgage technology company that is hyper-focused on defragmenting the critical last mile in the loan origination lifecycle, the closing process.

Spring EQ, Philadelphia, hired Saket Nigam as senior vice president of capital markets. He will be responsible for leading the company’s continued growth in the consumer-direct and wholesale mortgage markets for first and second mortgage products.