Commercial Property Prices Grow Again in January

U.S. commercial property prices grew again in January, sector analysts reported.

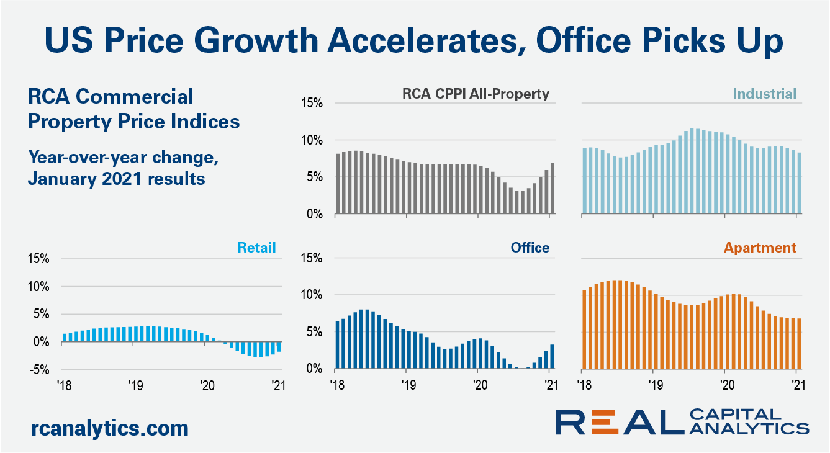

“The pace of U.S. commercial property price growth accelerated in January, climbing back near the growth rates seen before COVID-19 struck,” said Real Capital Analytics Senior Analyst Wyatt Avery. The RCA All-Property Index rose 1.2 percent from December and 6.9 percent from a year ago.

The acceleration in price growth came even as deal volume slumped again in January, Avery noted.

Office prices rebounded into the new year to a point 3.3 percent higher than January 2020. “As recently as August this index was posting no annual growth,” Avery said. “Suburban offices drove the increase.”

Industrial sector prices grew 8.3 percent annually, again ranking first among all the property types, RCA reported. Annual multifamily price growth equaled 6.8 percent, close to the 7 percent rate seen in recent months. The retail sector once again saw the worst annual price trend, falling 1.8 percent from a year prior.

Green Street, Newport Beach, Calif., reported its price index of real estate investment trust-owned properties increased 1.1 percent in January, reflecting higher valuations for lodging properties. Pricing in other REIT property sectors held steady.

Green Street’s all-property index now stands 7 percent below pre-COVID levels.

“Pricing of properties where the top line is less affected by the pandemic are flat to higher versus a year ago,” said Green Street Managing Director Peter Rothemund. “Property types heavily impacted by shutdowns–or where the ultimate impact from COVID is unknown–are seeing weaker pricing.”

Rothemund said the exact magnitude of price declines in the weaker sectors is hard to gauge given how little product is trading. “Most of the uncertainty surrounding real estate pricing should clear up over the next several months as the transaction market picks up, and when it does, we expect to see more upside surprises than the other way around,” he said.

CoStar, Washington, D.C., reported the share of “distressed” trades remained low in January. Despite a slow transaction pace, distressed sales remained about 2 percent of general commercial and 0.4 percent of investment-grade trades during the month. Both rates are well below their five-year averages of 1.8 percent and 0.9 percent, respectively. “The continued low share of distressed sales demonstrates relatively healthy liquidity conditions, despite low trading volumes,” CoStar said.