Winter Catches Up with February Housing Starts

Housing starts fell in February for the second straight month, HUD and the Census Bureau reported yesterday, with winter weather largely the culprit.

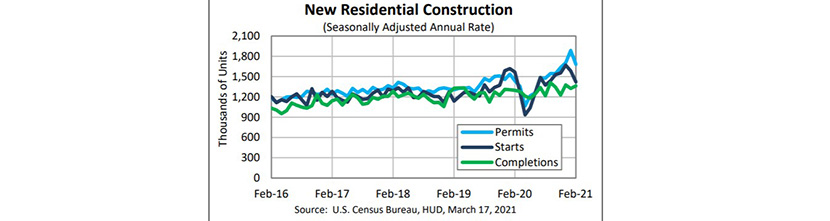

The report said privately owned housing starts in February came in at a seasonally adjusted annual rate of 1,421,000, 10.3 percent below the revised January estimate of 1,584,000 and 9.3 percent lower than a year ago (1,567,000). Single-family housing starts in February fell to 1,040,000, 8.5 percent below the revised January figure of 1,136,000. The February rate for units in buildings with five units or more fell to 372,000, down by 14.5 percent from January and by nearly 28 percent from a year ago.

Every region saw February declines in starts except for the West, which saw a 17.6 percent increase to 440,000 units, seasonally annually adjusted, from 374,000 units in January. From a year ago, starts in the West improved by nearly 16 percent.

Elsewhere, it was a different story. In the South, starts declined by 9.7 percent in February to 535,000 units, seasonally annually adjusted, from 637,000 units in January and fell by 16.6 percent from a year ago. In the Midwest, starts dropped by nearly 35 percent to 138,000 units in February from 212,000 units in January and fell by nearly 30 percent from a year ago. In the Northeast, starts fell by 39.5 percent in February to 118,000 units from 195,000 units in January and fell by 2.5 percent from a year ago.

“Winter weather finally arrived in force during February, abruptly reversing what had been exceptionally strong starts over the prior two months,” said Mark Vitner, Senior Economist with Wells Fargo Securities. “While the recent rise in long-term interest rates will be eyed as a contributor to February’s declines, we believe the drop was mostly due to harsh winter weather in Texas, which accounts for a large proportion of the nation’s housing starts. Some builders may also have refrained from starting projects due to soaring building materials prices, most notably lumber. The rise in rates really did not really get under way until March.”

Vitner said undoubtedly, the housing market is “cooling off somewhat” from the exceptionally strong pace seen late last year. “At that point, demand was clearly exceeding supply, leading to a surge in home prices,” he said. “Inventories of new and existing homes also remain exceptionally low, which is great news for home builders. Rising mortgage rates will likely temper demand somewhat this spring, but should not undermine demand in a major way as long mortgage rates maintain a 3% handle.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said while the harsh February weather hurt builder momentum, rising permits and an increase in construction jobs offer hope for more supply, even as material costs soar.

“The strong demographically driven demand for housing is an opportunity for builders to break ground on new home construction and help solve the inventory crisis,” Kushi said. “Yet supply-side headwinds remain: high costs for materials (lumber), a lack of affordable lots and costly regulations.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said the period of rapid housing acceleration has passed. “Robust construction activity is likely this year due to extremely tight inventories of existing homes for sale; however, homebuilders continue to face supply constraints, most notably labor, lumber and other materials,” he said. “Additionally, the recent increase in interest rates and the waning effect of the COVID-19 disruption to homebuyers’ purchasing timelines is, in our view, likely to modestly cool demand for new homes following a near-term rebound.”

The report said privately owned housing units authorized by building permits in February fell to a seasonally adjusted annual rate of 1,682,000, 10.8 percent below the revised January rate of 1,886,000, but 17 percent higher than a year ago (1,438,000). Single-family authorizations in February fell to 1,143,000; 10 percent below the revised January figure of 1,270,000. Authorizations of units in buildings with five units or more fell to 495,000 in February, down by 11.6 percent from January but up by 24.1 percent from a year ago.

HUD/Census said privately owned housing completions in February rose to a seasonally adjusted annual rate of 1,362,000, 2.9 percent higher than the revised January estimate of 1,324,000 and 5 percent higher than a year ago (1,297,000). Single-family housing completions in February rose to 1,042,000, 2.8 percent higher than the revised January rate of 1,014,000. The February rate for units in buildings with five units or more rose to 314,000, up by 3 percent from January and by nearly 13 percent from a year ago.