Yearly Home Flipping Sales Fall for 1st Time Since 2014

ATTOM Data Solutions, Irvine, Calif., reported a sharp decline in home flipping in 2020, the first decline since 2014 to the lowest level in nearly five years.

The company’s year-end 2020 U.S. Home Flipping Report showed 241,630 single-family homes and condos in the United States flipped in 2020, down 13.1 percent from 2019 to the lowest point since 2016. Homes flipped in 2020 represented 5.9 percent of all home sales in the nation during the year, down from 6.3 percent in 2019 to the same percentage seen in 2018. The declines in the number of homes flipped in 2020, as well as the portion of home sellers represented by investors, marked the first time since 2014 that both measures decreased annually.

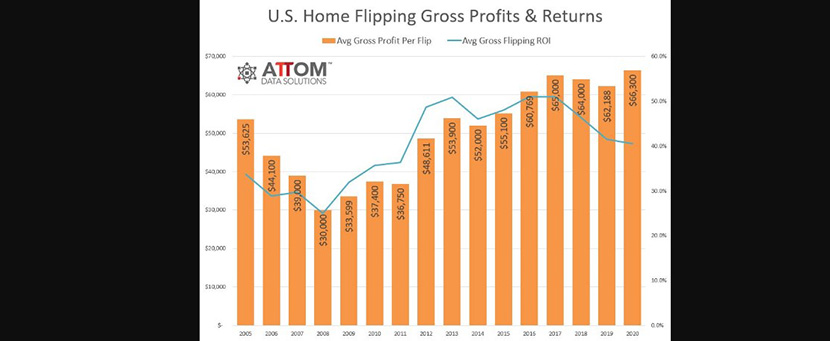

While flipping activity declined, gross profits and profit margins shifted in opposite directions. Profits rose in 2020, but profit margins dipped – the third straight year that returns on investments declined. Homes flipped in 2020 typically generated a gross profit of $66,300 nationwide, up 6.6 percent from $62,188 in 2019 to the highest point since at least 2005.

But the typical gross flipping profit of $66,300 translated into just a 40.5 percent return on investment compared to the original acquisition price. The latest ROI fell from 41.5 percent in 2019 and from 46.4 percent in 2018. The 2020 ROI was off more than 10 percentage points from peaks over the past decade in 2016 and 2017. The 2020 figure also stood at the lowest point since 2011.

The report said investors saw their profit margins dip again during a year when the median value of the homes they flipped rose more slowly than the median price they paid to purchase properties – 8.4 percent versus 9.1 percent. The decline in home-flipping profits marked a rare weak spot in the U.S. housing market, which otherwise boomed in 2020 despite economic damage caused by the worldwide coronavirus pandemic.

“Last year was a banner year for the U.S. housing market, with the apparent exception of the home-flipping business, which saw its fortunes slide a bit more in 2020,” said Todd Teta, chief product officer with ATTOM Data Solutions. “Home flippers did still make a nice profit on investments that generally take around six months to turn around – just not as much as they did in the previous few years.”

Teta said it’s too early to know if that small slide was a sign of weakness in the broader housing market or just a bump in the road. “We will know much more as we gauge other key market metrics in the coming months,” he said.

Key report findings:

–Home flips as a portion of all home sales decreased from 2019 to 2020 in 126 of the 198 metropolitan statistical areas analyzed in the report (63.6 percent). Nine of the 10 biggest decreases in annual flipping rates among MSAs came in the South and West, led by San Antonio, Texas (rate down 27.3 percent) and Tuscaloosa, Ala. (down 25.7 percent.

–Nationally, the percentage of flipped homes purchased with financing dipped in 2020 to 41.7 percent, down from 42.3 percent in 2019 and from 41.8 percent two years ago. The annual decrease was the first since 2010. Meanwhile, 58.3 percent of homes flipped in 2020 were bought with all-cash, up from 57.7 percent in 2019 and from 58.2 percent in 2018.

–Homes flipped in 2020 sold for a median price nationwide of $230,000, with a gross flipping profit of $66,300 above the median original purchase price paid by investors of $163,700. That national gross-profit figure was up from $62,188 in 2019 and from $64,000 in 2018 to the highest level since at least 2005.

–The profit margin on the typical flip in the U.S. last year fell to 40.5 percent, from a 41.5 percent in 2019 and 46.4 percent in 2018. The typical 2020 ROI was off more than 10 percentage points from peaks during the past decade of 51 percent in 2016 and 2017.

–Home flippers who sold homes in 2020 took an average of 181 days to complete the flips, up slightly from an average of 177 days for homes flipped in 2019 and 178 days in 2018.

–Of the 241,630 U.S. homes flipped in 2020, 14 percent were sold to buyers using a loan backed by the Federal Housing Administration, up for the second consecutive year from 13.8 percent in 2019 and 12.6 percent in 2018.